Rising Demand for Data-Driven Insights

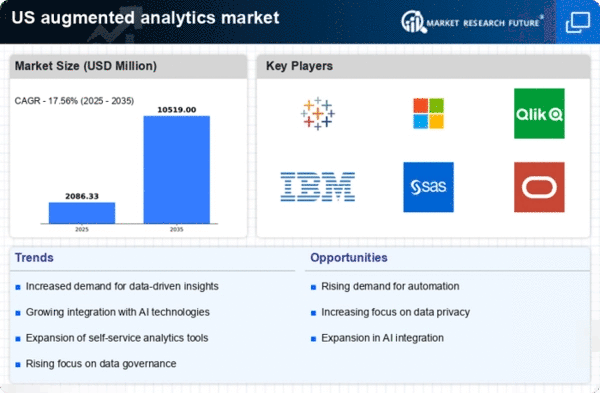

The The augmented analytics market is experiencing a surge in demand for data-driven insights across various sectors. Organizations are increasingly recognizing the value of leveraging data to enhance decision-making processes. According to recent estimates, the market is projected to grow at a CAGR of approximately 25% from 2025 to 2030. This growth is driven by the need for businesses to remain competitive in a rapidly evolving landscape. Companies are investing in augmented analytics solutions to gain actionable insights from their data, thereby improving operational efficiency and customer satisfaction. As a result, the augmented analytics market is becoming a critical component of strategic planning and execution for organizations aiming to harness the full potential of their data.

Growing Emphasis on Real-Time Analytics

The growing emphasis on real-time analytics is significantly impacting the augmented analytics market. Businesses are increasingly seeking solutions that provide immediate insights, enabling them to respond swiftly to market changes and customer needs. This trend is particularly evident in sectors such as retail and finance, where timely data can lead to competitive advantages. The demand for real-time analytics tools is projected to increase by over 30% in the next few years, reflecting a shift towards more agile decision-making processes. Consequently, the augmented analytics market is evolving to meet these demands, offering solutions that facilitate real-time data processing and visualization.

Increased Focus on User-Friendly Interfaces

The augmented analytics market is witnessing an increased focus on user-friendly interfaces, which is essential for driving adoption among non-technical users. As organizations strive to democratize data access, the demand for intuitive analytics tools is rising. Companies are prioritizing the development of platforms that allow users to easily interact with data, generate reports, and derive insights without extensive training. This trend is crucial as it enables a broader range of employees to engage with data analytics, fostering a data-driven culture within organizations. The emphasis on user experience is likely to propel the growth of the augmented analytics market, making it more accessible to diverse user groups.

Expansion of Cloud-Based Analytics Solutions

The expansion of cloud-based analytics solutions is reshaping the landscape of the augmented analytics market. As organizations migrate to cloud environments, they are increasingly adopting cloud-based analytics tools that offer scalability, flexibility, and cost-effectiveness. This shift is driven by the need for businesses to access and analyze data from various sources without the constraints of traditional on-premises systems. The cloud analytics market is anticipated to grow to $50 billion by 2027, indicating a strong trend towards cloud adoption. As a result, the augmented analytics market is likely to benefit from this transition, providing users with enhanced capabilities for data analysis and collaboration.

Integration of Advanced Machine Learning Techniques

The integration of advanced machine learning techniques into the augmented analytics market is transforming how organizations analyze and interpret data. Machine learning algorithms enable more sophisticated data processing, allowing for predictive analytics and automated insights generation. This trend is particularly relevant as businesses seek to enhance their analytical capabilities without requiring extensive data science expertise. The market for machine learning in analytics is expected to reach $10 billion by 2026, indicating a robust growth trajectory. As organizations adopt these technologies, the augmented analytics market is likely to expand, providing users with more intuitive and powerful tools for data analysis.