Rise of Collaborative Analytics

The trend towards collaborative analytics is reshaping the augmented analytics market in Canada. Organizations are increasingly recognizing the value of collaborative approaches to data analysis, where teams can work together to derive insights. This shift is fostering a culture of data sharing and collective decision-making, which is essential for driving innovation. As a result, the augmented analytics market is likely to expand as tools that facilitate collaboration become more prevalent, enabling organizations to harness the collective intelligence of their workforce.

Increased Focus on Customer Experience

The augmented analytics market in Canada is being driven by an intensified focus on customer experience. Organizations are leveraging analytics to gain deeper insights into customer behavior and preferences, enabling them to tailor their offerings accordingly. This trend is reflected in the fact that nearly 60% of Canadian companies are investing in analytics solutions to enhance customer engagement. As businesses strive to create personalized experiences, the augmented analytics market is likely to see a corresponding increase in demand for tools that facilitate customer-centric analytics.

Advancements in Data Visualization Tools

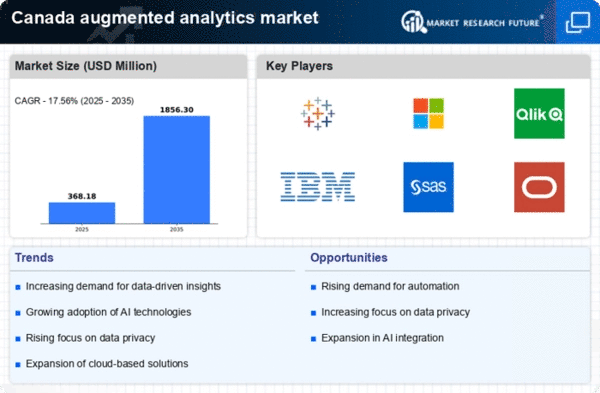

Innovations in data visualization tools are significantly impacting the augmented analytics market in Canada. Enhanced visualization capabilities allow users to interpret complex data more intuitively, facilitating better insights and faster decision-making. As organizations increasingly adopt these tools, the market is projected to grow at a compound annual growth rate (CAGR) of around 25% over the next five years. This growth is indicative of the rising importance of visual data representation in the augmented analytics market, as businesses seek to empower users with accessible and actionable insights.

Regulatory Compliance and Data Governance

Regulatory compliance and data governance are becoming critical drivers for the augmented analytics market in Canada. With the implementation of stringent data protection regulations, organizations are compelled to adopt analytics solutions that ensure compliance while maximizing data utility. This necessity is pushing companies to invest in augmented analytics tools that not only provide insights but also adhere to regulatory standards. The augmented analytics market is thus poised for growth as businesses seek to navigate the complexities of data governance while leveraging analytics for strategic advantage.

Growing Demand for Data-Driven Decision Making

The augmented analytics market in Canada is experiencing a surge in demand as organizations increasingly recognize the value of data-driven decision making. Businesses are seeking to leverage data analytics to enhance operational efficiency and improve customer experiences. According to recent statistics, approximately 70% of Canadian enterprises are prioritizing data analytics initiatives, indicating a robust market potential. This trend is likely to drive investments in augmented analytics solutions, as companies aim to harness insights from vast data sets. The augmented analytics market is thus positioned to benefit from this growing emphasis on data utilization, as organizations strive to remain competitive in a rapidly evolving landscape.