Fraud Detection and Prevention

Fraud detection and prevention is a pivotal driver in the Applied AI in Finance Market. Financial institutions are increasingly adopting AI technologies to combat the rising threat of fraudulent activities. AI systems can analyze transaction patterns and identify anomalies in real-time, significantly enhancing the ability to detect fraud. Recent studies indicate that AI-driven fraud detection solutions can reduce false positives by up to 50%, thereby improving operational efficiency. The market for AI in fraud detection is projected to grow at a robust pace, with estimates suggesting it could reach USD 10 billion by 2025. This growth is fueled by the need for more sophisticated security measures in an increasingly digital financial landscape.

Customer Experience Enhancement

Enhancing customer experience is a vital driver in the Applied AI in Finance Market. Financial institutions are leveraging AI technologies to provide personalized services and improve customer interactions. AI-driven chatbots and virtual assistants are becoming commonplace, offering 24/7 support and tailored financial advice. This shift towards customer-centric services is expected to drive market growth, with projections indicating that AI in customer service could reach USD 15 billion by 2026. By utilizing AI, organizations can analyze customer behavior and preferences, allowing them to offer customized solutions that meet individual needs. This focus on enhancing customer experience is likely to foster loyalty and retention in a competitive market.

Regulatory Compliance and Reporting

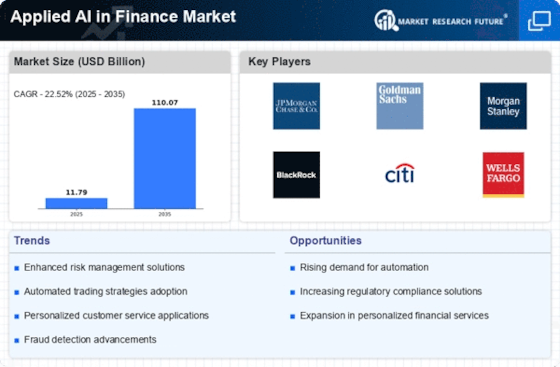

Regulatory compliance remains a critical driver in the Applied AI in Finance Market. Financial institutions are under increasing pressure to adhere to stringent regulations, which necessitates the implementation of advanced compliance solutions. AI technologies are being utilized to automate compliance processes, thereby reducing the risk of human error and ensuring timely reporting. The market for AI in compliance is expected to grow significantly, with estimates suggesting a compound annual growth rate of over 25% in the coming years. By employing AI-driven solutions, organizations can streamline their compliance efforts, enhance transparency, and mitigate potential legal risks. This trend underscores the importance of integrating AI into compliance frameworks to maintain operational integrity and foster trust among stakeholders.

Enhanced Data Analytics Capabilities

The Applied AI in Finance Market is experiencing a surge in demand for enhanced data analytics capabilities. Financial institutions are increasingly leveraging AI technologies to analyze vast amounts of data, enabling them to derive actionable insights. This trend is driven by the need for improved decision-making processes and risk assessment. According to recent estimates, the market for AI-driven analytics in finance is projected to reach USD 20 billion by 2026. The ability to process and analyze data in real-time allows firms to respond swiftly to market changes, thereby enhancing their competitive edge. As a result, organizations are investing heavily in AI tools that facilitate predictive analytics, which is becoming a cornerstone of strategic planning in the finance sector.

Cost Efficiency and Operational Optimization

Cost efficiency and operational optimization are crucial drivers in the Applied AI in Finance Market. Financial institutions are increasingly adopting AI technologies to streamline operations and reduce costs. Automation of routine tasks through AI can lead to significant savings, allowing organizations to allocate resources more effectively. Recent analyses suggest that AI implementation can reduce operational costs by up to 30% in certain areas. This trend is particularly relevant as firms seek to enhance profitability in a challenging economic environment. By optimizing operations through AI, financial institutions can improve service delivery and maintain a competitive advantage, thereby solidifying their position in the market.