Data-Driven Decision Making

In the applied ai-in-finance market, the shift towards data-driven decision making is a pivotal driver. Financial institutions are increasingly recognizing the value of big data analytics to enhance their operational efficiency and customer insights. By 2025, it is projected that the UK financial services sector will invest approximately £3 billion in AI technologies aimed at improving data analysis capabilities. This investment is expected to empower firms to make informed decisions, optimize risk assessments, and tailor financial products to meet customer needs, thereby propelling the growth of the applied ai-in-finance market.

Regulatory Compliance Pressure

The applied ai-in-finance market is increasingly influenced by the stringent regulatory landscape in the UK. Financial institutions are compelled to adopt advanced technologies to ensure compliance with regulations such as the Financial Services and Markets Act. This act mandates transparency and accountability, pushing firms to leverage AI for monitoring transactions and detecting anomalies. As of 2025, it is estimated that compliance costs could reach £7 billion annually for the financial sector. Consequently, the demand for AI-driven solutions that facilitate compliance is likely to surge, driving growth in the applied ai-in-finance market.

Customer Experience Enhancement

Enhancing customer experience remains a critical driver in the applied ai-in-finance market. Financial institutions are leveraging AI technologies to provide personalized services, streamline customer interactions, and improve service delivery. As of November 2025, it is anticipated that 60% of UK banks will implement AI-driven chatbots and virtual assistants to handle customer inquiries efficiently. This shift not only reduces operational costs but also fosters customer loyalty by providing timely and relevant financial advice. The focus on customer-centric solutions is likely to stimulate further growth in the applied ai-in-finance market.

Competitive Pressure and Innovation

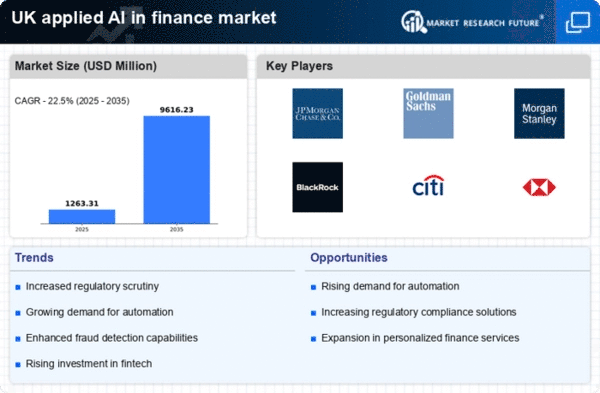

The applied ai-in-finance market is also shaped by competitive pressure among financial institutions. As new entrants and fintech companies leverage AI to disrupt traditional banking models, established firms are compelled to innovate. This competitive landscape drives investment in AI technologies to enhance product offerings and improve service delivery. By 2025, it is projected that the UK fintech sector will attract over £5 billion in investments, further intensifying competition. This environment of innovation and adaptation is likely to propel the applied ai-in-finance market forward.

Cost Efficiency and Operational Optimization

Cost efficiency is a significant driver in the applied ai-in-finance market, as financial institutions seek to optimize their operations. The integration of AI technologies enables firms to automate routine tasks, reduce manual errors, and streamline processes. By 2025, it is estimated that AI implementation could lead to a reduction in operational costs by up to 30% for major banks in the UK. This potential for cost savings is likely to encourage more institutions to invest in AI solutions, thereby accelerating the growth of the applied ai-in-finance market.