Growing Demand for Automation

The increasing demand for automation in financial services is significantly influencing the applied ai-in-finance market. In Germany, financial institutions are seeking to streamline operations and reduce costs, with automation technologies projected to save up to €1 billion annually across the sector. This trend is particularly evident in areas such as customer service, where AI-driven chatbots and virtual assistants are being deployed to handle routine inquiries, thereby freeing human resources for more complex tasks. The push for automation not only enhances efficiency but also improves customer satisfaction, as services become faster and more reliable. Consequently, the drive towards automation is expected to propel growth in the applied ai-in-finance market.

Increased Focus on Data Security

As financial institutions in Germany increasingly adopt AI technologies, the focus on data security has become paramount. The applied ai-in-finance market is witnessing a surge in demand for AI solutions that enhance cybersecurity measures. With cyber threats evolving, financial organizations are investing in AI-driven security systems that can detect anomalies and respond to threats in real-time. Reports indicate that the cost of cybercrime in Germany could reach €100 billion annually, underscoring the need for robust security frameworks. By leveraging AI for predictive analytics and threat detection, institutions can safeguard sensitive customer data and maintain trust, thereby driving growth in the applied ai-in-finance market.

Technological Advancements in AI

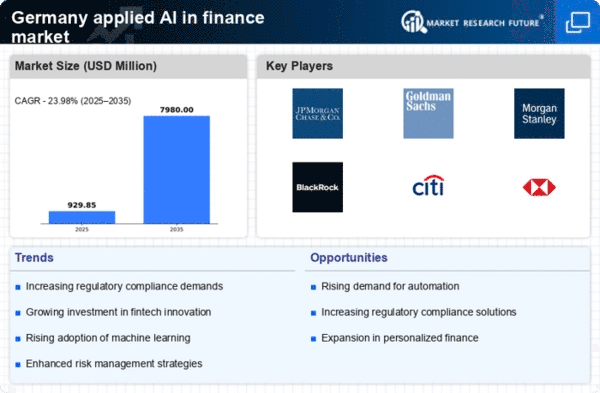

The rapid evolution of artificial intelligence technologies is a primary driver for the applied ai-in-finance market. In Germany, advancements in machine learning, natural language processing, and data analytics are enabling financial institutions to enhance their operational efficiency. For instance, the integration of AI algorithms in trading systems has shown to improve decision-making processes, potentially increasing profitability by up to 15%. Furthermore, the ability to analyze vast datasets in real-time allows for more accurate risk assessments and fraud detection. As these technologies continue to mature, they are likely to reshape the landscape of financial services, making AI an indispensable tool for competitive advantage in the applied ai-in-finance market.

Regulatory Changes and Compliance Needs

The evolving regulatory landscape in Germany is a critical driver for the applied ai-in-finance market. Financial institutions are under increasing pressure to comply with stringent regulations, which often require sophisticated reporting and monitoring systems. AI technologies are being utilized to automate compliance processes, reducing the risk of human error and ensuring adherence to regulations. For example, the implementation of AI-driven compliance solutions can decrease the time spent on regulatory reporting by up to 30%. As regulatory requirements continue to tighten, the demand for AI solutions that facilitate compliance is expected to rise, further propelling the applied ai-in-finance market.

Shift Towards Personalized Financial Services

The trend towards personalized financial services is reshaping the applied ai-in-finance market in Germany. Consumers are increasingly expecting tailored financial products and services that meet their individual needs. AI technologies enable financial institutions to analyze customer data and preferences, allowing for the creation of customized offerings. This shift is reflected in the growing use of robo-advisors, which provide personalized investment advice based on individual risk profiles. The market for personalized financial services is projected to grow by 20% annually, indicating a strong demand for AI-driven solutions that enhance customer engagement. As institutions adapt to these expectations, the applied ai-in-finance market is likely to expand significantly.