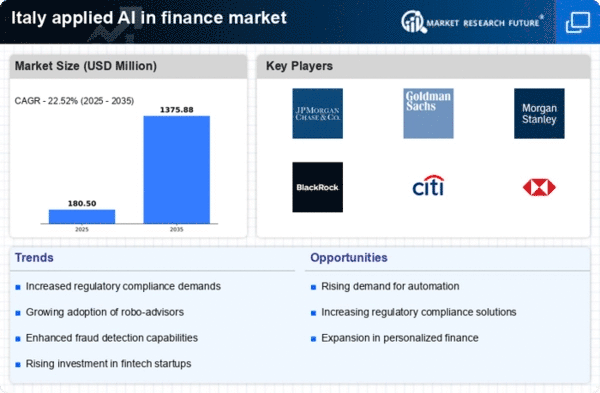

Growing Investment in Fintech Startups

Italy's applied ai-in-finance market is witnessing a notable increase in venture capital investments directed towards fintech startups. In 2025, investments in Italian fintech reached approximately €1.5 billion, reflecting a 25% growth from the previous year. This influx of capital is fostering innovation and the development of AI-based financial solutions, such as robo-advisors and automated trading systems. The competitive landscape is evolving as these startups leverage AI to offer personalized services, thereby attracting a younger demographic. This trend suggests that the applied ai-in-finance market will continue to expand as new players emerge.

Regulatory Compliance and AI Integration

The applied ai-in-finance market in Italy is experiencing a surge in demand for solutions that ensure compliance with stringent regulatory frameworks. The European Union's General Data Protection Regulation (GDPR) and the Anti-Money Laundering (AML) directives necessitate advanced technologies to monitor transactions and manage data securely. Financial institutions are increasingly adopting AI-driven tools to automate compliance processes, thereby reducing operational costs by up to 30%. This trend indicates a growing reliance on AI to navigate complex regulatory landscapes, which is likely to enhance the overall efficiency of the applied ai-in-finance market.

Advancements in Data Analytics Capabilities

The applied ai-in-finance market is benefiting from rapid advancements in data analytics technologies. Financial institutions in Italy are increasingly utilizing AI to analyze vast amounts of data, enabling them to make informed decisions and predict market trends. The integration of machine learning algorithms allows for real-time data processing, which enhances risk assessment and fraud detection capabilities. This trend is expected to drive the growth of the applied ai-in-finance market, as organizations seek to harness data-driven insights to improve operational efficiency and customer satisfaction.

Consumer Demand for Enhanced Financial Services

The applied ai-in-finance market in Italy is significantly influenced by the rising consumer demand for more efficient and personalized financial services. Recent surveys indicate that over 70% of Italian consumers prefer using AI-driven applications for banking and investment management. This shift in consumer behavior is prompting financial institutions to invest in AI technologies that enhance user experience and streamline service delivery. As a result, the applied ai-in-finance market is likely to see a transformation in service offerings, with a focus on user-centric solutions that cater to individual preferences.

Collaboration Between Financial Institutions and Tech Firms

The applied ai-in-finance market in Italy is characterized by a growing trend of collaboration between traditional financial institutions and technology firms. These partnerships are aimed at leveraging AI technologies to enhance service offerings and improve operational efficiency. For instance, banks are increasingly working with tech startups to develop innovative solutions that address specific market needs. This collaborative approach is likely to accelerate the adoption of AI in financial services, fostering a more dynamic and competitive landscape within the applied ai-in-finance market.