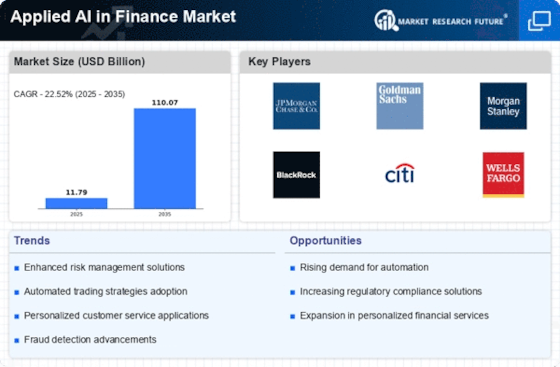

Top Industry Leaders in the Applied AI in Finance Market

Competitive Landscape of Applied AI in Finance Market:

The application of artificial intelligence (AI) in finance is undergoing a transformative boom, reshaping industries, and carving out a lucrative market segment. This intense competition attracts various players, from established financial institutions to agile fintech startups, all vying for dominance with their AI-powered solutions. Understanding the competitive landscape is crucial for navigating this dynamic market.

Key Players:

Strategies Adopted:

- Technology Differentiation: Players compete on the sophistication and accuracy of their AI algorithms, data security, and compliance with financial regulations. Providing explainable AI and transparent decision-making processes is gaining importance.

- Partnership Ecosystem: Collaboration is key. Established financial institutions partner with fintech startups for innovative solutions, while tech giants collaborate with banks to tailor their offerings to the specific needs of the financial sector.

- Customer-Centric Approach: Personalization and user experience are critical. AI-powered chatbots, personalized financial advice, and risk-based pricing are becoming differentiators as players strive to create frictionless customer journeys.

Factors for Market Share Analysis:

- Revenue Size and Growth: Analyzing company revenue and growth rate provides insights into market penetration and the effectiveness of adopted strategies.

- Product Portfolio and Customer Base: Diversified product portfolios catering to various financial needs and a diverse customer base indicate adaptability and market dominance.

- Investment in R&D and Talent Acquisition: Continuous investment in AI research and development, and attracting top AI talent, is crucial for maintaining a competitive edge in this rapidly evolving field.

New and Emerging Companies:

- RegTech Startups: Companies like Jumio and Socure are utilizing AI for Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance, addressing a critical pain point for financial institutions.

- Alternative Data Providers: Startups like Quandl and Enigma are using AI to analyze satellite imagery, internet traffic, and social media data, providing alternative data sources for investment research and risk management.

- Blockchain-powered AI Solutions: Companies like Ocean Protocol and SingularityNET are integrating AI with blockchain technology, aiming to create decentralized marketplaces for AI models and data, potentially disrupting traditional data ownership models.

Current Company Investment Trends:

- Cloud-based AI Platforms: Financial institutions are increasingly opting for cloud-based AI platforms, allowing for scalability and efficient resource utilization. This trend benefits cloud providers like AWS, Microsoft Azure, and Google Cloud Platform.

- Open-source AI Frameworks: Adoption of open-source AI frameworks like TensorFlow and PyTorch is gaining traction. This trend fosters collaboration and reduces software development costs, democratizing access to advanced AI tools.

- Talent Acquisition and Training: The war for talent is fierce. Financial institutions are investing heavily in attracting and training AI specialists, building in-house expertise to drive AI adoption and integration across various departments.

Latest Company Updates:

January 12, 2024, JPMorgan Chase has announced a partnership with OpenAI to leverage the latter's advanced language models for developing AI-powered tools in areas like risk management, market analysis, and customer service. This collaboration aims to improve efficiency, accuracy, and personalization in financial services.

January 10, 2024, Goldman Sachs has rolled out a new AI-driven algorithmic trading platform called "Goldman Sachs Helios." This platform utilizes machine learning algorithms to analyze market data, identify trading opportunities, and execute trades automatically with minimal human intervention.

January 9, 2024, The Financial Conduct Authority (FCA) in the UK has issued a warning to financial institutions about the potential risks of overreliance on AI-powered credit scoring models. The FCA highlights concerns about bias, lack of transparency, and potential discrimination against certain demographics.