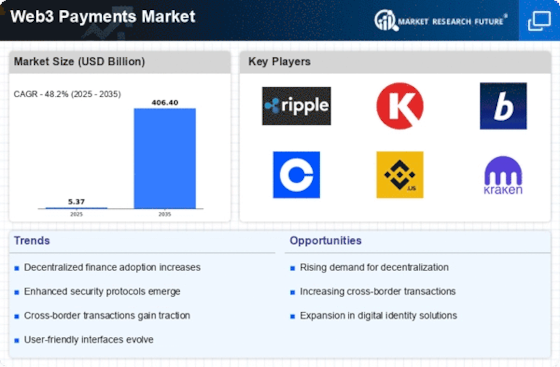

Rise of Cryptocurrency Usage

The increasing acceptance of cryptocurrencies as a legitimate form of payment is a pivotal driver for the Web3 Payments Market. As more businesses and consumers embrace digital currencies, the demand for seamless payment solutions rises. In 2025, it is estimated that over 300 million people will use cryptocurrencies for transactions, reflecting a significant shift in payment preferences. This trend is further fueled by the growing number of platforms facilitating cryptocurrency transactions, which enhances accessibility and usability. Consequently, the Web3 Payments Market is likely to experience substantial growth as it adapts to the evolving landscape of digital currency usage.

Consumer Demand for Enhanced Privacy

As concerns over data privacy and security continue to rise, the Web3 Payments Market is witnessing a growing demand for payment solutions that prioritize user privacy. Consumers are increasingly wary of traditional payment systems that require extensive personal information. Web3 payment solutions, which often utilize decentralized networks, can offer enhanced privacy features, appealing to privacy-conscious users. In 2025, it is projected that the market for privacy-focused payment solutions will grow significantly, as more individuals seek alternatives that protect their financial data. This shift towards privacy-centric solutions is likely to drive innovation and adoption within the Web3 Payments Market.

Advancements in Blockchain Technology

Technological innovations in blockchain are transforming the Web3 Payments Market. Enhanced scalability, speed, and efficiency of blockchain networks are making them more suitable for payment processing. For instance, the implementation of layer-2 solutions has significantly reduced transaction times and costs, making blockchain a more attractive option for businesses. As of 2025, the market for blockchain technology is projected to reach approximately 67 billion USD, indicating a robust interest in its applications, including payments. This technological evolution is likely to drive the adoption of Web3 payment solutions, as businesses seek to leverage the benefits of blockchain.

Regulatory Developments and Compliance

The evolving regulatory landscape surrounding cryptocurrencies and digital payments is a crucial factor influencing the Web3 Payments Market. Governments are increasingly recognizing the need for frameworks that ensure consumer protection and financial stability. In 2025, it is anticipated that more than 50 countries will have established comprehensive regulations for digital currencies, which could enhance trust and legitimacy in the market. This regulatory clarity may encourage more businesses to adopt Web3 payment solutions, as compliance becomes more manageable. Thus, the Web3 Payments Market stands to benefit from a more structured environment that fosters innovation while safeguarding users.

Growing Demand for Cross-Border Transactions

The need for efficient cross-border payment solutions is driving growth in the Web3 Payments Market. Traditional payment systems often impose high fees and lengthy processing times for international transactions. In contrast, Web3 payment solutions offer lower costs and faster processing, appealing to businesses engaged in global trade. By 2025, it is estimated that cross-border payments will exceed 30 trillion USD, highlighting the immense potential for Web3 solutions to capture this market. As businesses seek to optimize their payment processes, the Web3 Payments Market is likely to see increased adoption of decentralized payment methods that facilitate international transactions.