North America : Digital Payment Leaders

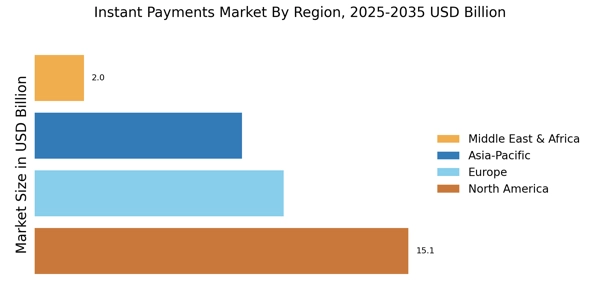

North America is the largest market for instant payments, holding approximately 45% of the global share. The region's growth is driven by high smartphone penetration, increasing consumer demand for seamless transactions, and supportive regulatory frameworks. The U.S. government has been proactive in promoting digital payment solutions, enhancing security measures, and fostering innovation in the financial sector. The competitive landscape is robust, with key players like Visa, Mastercard, and PayPal leading the charge. The presence of innovative platforms such as Zelle and Square further strengthens the market. The U.S. is the largest contributor, while Canada follows as the second-largest market, contributing around 10% to the overall share. The collaboration between fintech companies and traditional banks is also a significant trend, enhancing service offerings.

Europe : Regulatory Frameworks Evolving

Europe is witnessing a significant transformation in the instant payments market, holding approximately 30% of the global share. The European Union's regulatory initiatives, such as the Payment Services Directive 2 (PSD2), are driving innovation and competition among payment service providers. The demand for instant payments is fueled by the increasing adoption of digital banking and e-commerce, with consumers seeking faster and more efficient transaction methods. Leading countries in this region include Germany, France, and the UK, with Germany being the largest market, contributing around 12% to the global share. The competitive landscape features key players like Revolut, Skrill, and N26, which are rapidly gaining traction. The collaboration between traditional banks and fintech firms is enhancing service delivery, making instant payments more accessible to consumers across Europe.

Asia-Pacific : Emerging Market Dynamics

Asia-Pacific is an emerging powerhouse in the instant payments market, accounting for approximately 25% of the global share. The region's growth is driven by the rapid digitalization of financial services, increasing smartphone usage, and a young, tech-savvy population. Countries like China and India are at the forefront, with significant investments in digital payment infrastructure and government initiatives promoting cashless transactions. China, with platforms like Alipay and WeChat Pay, leads the market, while India follows closely with its UPI system. The competitive landscape is characterized by a mix of established players and innovative startups, creating a dynamic environment. The region's diverse regulatory frameworks are also evolving to support the growth of instant payments, ensuring a secure and efficient payment ecosystem.

Middle East and Africa : Untapped Potential

The Middle East and Africa (MEA) region is gradually emerging in the instant payments market, holding around 5% of the global share. The growth is primarily driven by increasing smartphone penetration, a young population, and a rising middle class seeking convenient payment solutions. Governments in the region are also implementing policies to promote financial inclusion and digital payment adoption, which are crucial for market expansion. Leading countries include South Africa and the UAE, where fintech innovations are gaining momentum. The competitive landscape is evolving, with local players and international companies entering the market. The presence of key players is growing, and partnerships between banks and fintech firms are becoming more common, paving the way for enhanced payment solutions in the region.