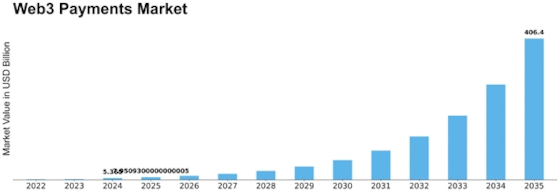

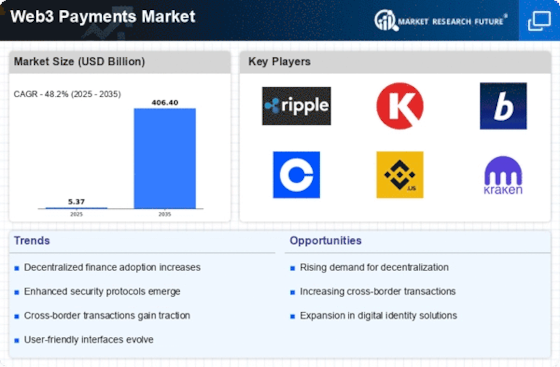

Web3 Payments Size

Web3 Payments Market Growth Projections and Opportunities

Web3 payments' market aspects are changing rapidly due to decentralization, blockchain technology, and online development. Decentralized, blockchain-based Web3 payments prioritize security, simplicity, and user control above traditional monetary systems. Several factors shape the Web3 payments business.

First and foremost, blockchain technology shapes Web3 payments' market aspects. Blockchain provides a simple, secure record that allows secure, irrefutable trades without middlemen. The decentralized blockchain concept records trades on a network of hubs, reducing the risk of extortion and improving Web3 payment security.

The Web3 payments market relies on digital money and blockchain. Bitcoin, Ethereum, and other stablecoins enable distributed exchanges, online payments, and decentralized financial administrations. Decentralised finance (DeFi) platforms that offer a variety of financial services without relying on centralised institutions are growing as cryptographic currencies become more popular as a trading mechanism.

Decentralized finance (DeFi) phases drive Web3 payment industry aspects. These steps enable smart agreements, programmable self-executing contracts, to handle lending, buying, selling, and other financial transactions without middlemen. The rise of DeFi allows customers to buy interest, participate in liquidity pools, and access monetary administrations permissionlessly, transforming Web3 payments and exchanges.

Tokenization is crucial to Web3 payments. Tokens address blockchain resources, making value transfer more efficient and fluid. In Web3, tokenized resources like land, craftsmanship, and protected invention may be transferred consistently. Tokenization expands Web3 payments beyond traditional monetary norms, creating a more diverse and complete financial landscape.

Web3 payments industry aspects are shaped by interoperability. As the Web3 biological system incorporates several blockchain organizations and norms, stages must be able to reliably link and move value. Interoperable blockchain scaffolds and cross-chain protocols allow clients to switch between blockchain networks for speedier and more accessible Web3 payments.

Coordination of decentralized character arrangements advances Web3 payments. Decentralised character phases enable blockchain technology to give customers control over their data, improving payment security. Clients can manage their complex personalities across stages, reducing Web3 payment character check dependency on concentrated aspects.

Global administrative considerations affect Web3 payment industry aspects. Administrative organizations are studying ways to manage decentralized money and digital currencies when they become mainstream. Trust and wider Web3 payment acceptance depend on administrative clarity and consistency. The administrative environment will likely define Web3 installment arrangements, impacting market factors and standard acceptance.

Growing awareness and acceptance of Web3 standards boost Web3 payments' commercial components. As consumers learn about the benefits of decentralization, increased security, and improved safety in financial exchanges, Web3 installment agreements gain popularity. This shift in consumer thinking is leading companies, financial institutions, and installation specialist co-ops to research and use Web3 installment technologies to satisfy customer expectations.

Leave a Comment