Rise of E-commerce and Online Shopping

The rise of e-commerce and online shopping is significantly impacting the mobile payments market. With more consumers opting for online purchases, the demand for seamless mobile payment solutions has escalated. In 2025, it is projected that mobile payments will account for nearly 30% of all e-commerce transactions in the US. This shift is driven by the increasing reliance on smartphones for shopping, as consumers appreciate the convenience of making purchases directly from their devices. Retailers are adapting by optimizing their platforms for mobile transactions, which is likely to further enhance the mobile payments market. The integration of mobile payment options into e-commerce platforms not only facilitates transactions but also improves customer satisfaction, as users can complete purchases quickly and securely. This trend suggests a robust future for mobile payments as e-commerce continues to flourish.

Consumer Demand for Convenience and Speed

In the current landscape, consumer demand for convenience and speed is a primary driver of the mobile payments market. As lifestyles become increasingly fast-paced, consumers are seeking payment solutions that minimize transaction times and enhance convenience. Surveys indicate that over 70% of consumers prefer mobile payments for their speed and ease of use. This trend is particularly pronounced among younger demographics, who are more likely to embrace mobile payment solutions. Retailers and service providers are responding by integrating mobile payment options into their platforms, further fueling the growth of the mobile payments market. The convenience factor is not just a preference; it is becoming a necessity in a competitive marketplace where customer experience is paramount. As a result, businesses that adopt mobile payment solutions may gain a competitive edge, potentially increasing their market share.

Government Initiatives and Regulatory Support

Government initiatives and regulatory support are playing a crucial role in shaping the mobile payments market. Policies aimed at promoting digital payments and financial inclusion are encouraging the adoption of mobile payment solutions. In recent years, various state and federal programs have been introduced to facilitate the growth of digital payment systems, which is likely to enhance the mobile payments market. For instance, initiatives that support the development of infrastructure for mobile payments can lead to increased accessibility for consumers. Additionally, regulatory frameworks that ensure consumer protection and data privacy are essential for building trust in mobile payment systems. As these initiatives gain traction, they may create a more favorable environment for the mobile payments market, potentially leading to increased investment and innovation in the sector.

Technological Advancements in Payment Systems

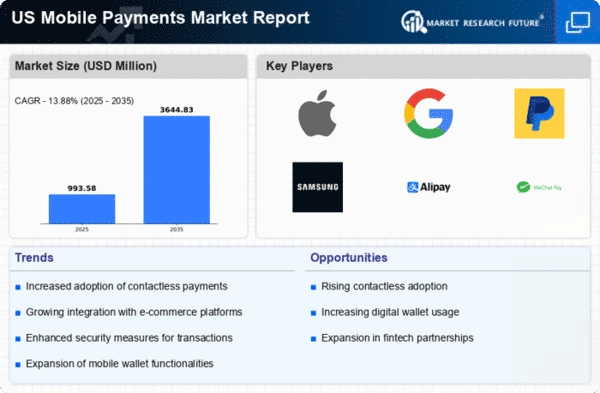

The mobile payments market is experiencing a surge due to rapid technological advancements in payment systems. Innovations such as Near Field Communication (NFC) and QR code scanning have streamlined transaction processes, making them faster and more efficient. In 2025, it is estimated that NFC transactions will account for approximately 40% of all mobile payment transactions in the US. This shift towards more sophisticated payment technologies is likely to enhance user experience and drive further adoption. As consumers become more accustomed to these technologies, the mobile payments market is expected to expand significantly, with projections indicating a compound annual growth rate (CAGR) of around 15% over the next five years. This growth is indicative of a broader trend towards digitalization in financial services, positioning the mobile payments market as a key player in the evolving landscape of commerce.

Increased Focus on Security and Fraud Prevention

As the mobile payments market expands, there is an increased focus on security and fraud prevention measures. Consumers are becoming more aware of the potential risks associated with mobile transactions, prompting businesses to invest in advanced security technologies. Features such as biometric authentication and tokenization are being integrated into mobile payment systems to enhance security. In 2025, it is estimated that nearly 60% of mobile payment users prioritize security features when choosing a payment method. This emphasis on security is likely to bolster consumer confidence in mobile payments, driving further adoption. As security technologies evolve, they may not only protect users but also attract new customers who are hesitant to engage in mobile transactions. Consequently, the mobile payments market may see accelerated growth as security becomes a cornerstone of consumer trust.