Top Industry Leaders in the Web3 Payments Market

Competitive Landscape of the Web3 Payments Market: A Shifting Landscape

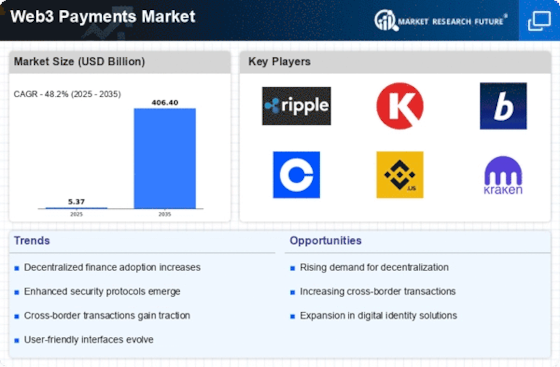

The Web3 payments market, fueled by decentralization and blockchain technology, is undergoing a rapid evolution, challenging traditional financial systems and reshaping the way we transact. This burgeoning market, projected to reach a multi-billion dollar valuation within the next decade, attracts established players and innovative startups alike, creating a dynamic and competitive landscape.

Key Players:

-

Filecoin

-

Web3 Foundation

-

Zel Technologies Limited

-

Livepeer Inc

-

Brunswick Corporation

-

Helium Systems Inc

-

Kusama

-

Polygon Technology

-

Kadena LLC

-

Ocean Protocol Foundation Ltd

Strategies for Gaining Market Share:

-

Technological Innovation: Developing novel blockchain-based payment protocols, integrating AI and machine learning for fraud prevention, and enhancing user experience through intuitive interfaces are crucial for differentiation.

-

Partnerships and Collaborations: Forging alliances with established players and emerging companies across the Web3 ecosystem allows for wider reach, shared resources, and access to new user bases.

-

Compliance and Regulation: Navigating the evolving regulatory landscape and prioritizing security and transparency are key to building trust and attracting institutional investors and mainstream merchants.

-

Community Building: Engaging with the crypto community through active social media presence, developer outreach programs, and educational initiatives fosters brand loyalty and drives adoption.

Factors for Market Share Analysis:

-

Transaction Volume and Value: Assessing the volume and value of transactions processed through a platform provides insight into its market reach and user base.

-

Supported Assets: The variety of cryptocurrencies and stablecoins supported by a platform broadens its appeal and attracts users with diverse investment portfolios.

-

Geographic Reach: Global reach and the ability to facilitate cross-border transactions are important factors for achieving market dominance.

-

Fees and Pricing Structures: Competitive pricing models and transparent fee structures attract both merchants and individual users.

-

Technology and Innovation: The adoption of cutting-edge technologies and the ability to develop unique solutions for specific use cases position a platform as a leader in the market.

New and Emerging Companies:

-

Layer 2 Scaling Solutions: Polygon, Optimism, and Arbitrum are addressing scalability challenges of Ethereum, enabling faster and cheaper transactions, which is crucial for mass adoption of Web3 payments.

-

Non-Fungible Token (NFT) Payment Gateways: Alchemy, Rarible, and OpenSea are building payment infrastructure for the booming NFT market, facilitating purchases and royalties in a secure and transparent manner.

-

Metaverse Payment Solutions: Decentraland, The Sandbox, and Axie Infinity are developing virtual economies within the metaverse, requiring innovative payment solutions for in-world purchases and transactions.

Current Investment Trends:

-

Venture Capital: VC firms are increasingly pouring funds into Web3 payments startups, recognizing the potential for disruptive innovation and long-term growth.

-

Strategic Investments: Established players are investing in promising startups and collaborating with them to expand their offerings and gain a foothold in new markets.

-

Tokenization and DAOs: Some companies are exploring tokenization of their platforms and forming decentralized autonomous organizations (DAOs) to involve the community in governance and decision-making.

Latest Company Updates:

-

Jan 18, 2024: Meta announces plans to integrate Web3 payments into its metaverse platform, Horizon Worlds.

-

Jan 12, 2024: Circle launches a stablecoin-based payment network for businesses, aiming to compete with traditional card networks.

-

Jan 5, 2024: Mastercard acquires blockchain security firm CipherTrace, indicating its commitment to Web3 security and compliance.