Regulatory Compliance

Stringent regulations regarding data protection and privacy are compelling organizations to adopt comprehensive video surveillance systems. The Video Surveillance Storage Market is influenced by laws that mandate the secure storage and management of surveillance data. Compliance with regulations such as the General Data Protection Regulation (GDPR) necessitates the implementation of advanced storage solutions that ensure data integrity and security. As organizations strive to meet these legal requirements, the demand for specialized storage systems is likely to increase. In 2025, it is anticipated that the market will witness a growth rate of around 10%, driven by the need for compliance and the associated investments in secure storage technologies.

Rising Security Concerns

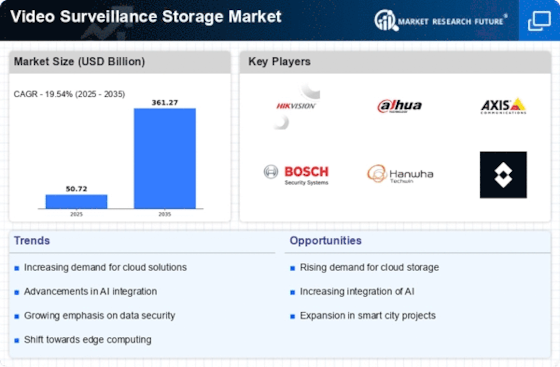

The increasing prevalence of security threats, including theft, vandalism, and terrorism, drives the demand for enhanced surveillance systems. As organizations and governments prioritize safety, the Video Surveillance Storage Market experiences a surge in demand for robust storage solutions. In 2025, the market is projected to grow significantly, with a compound annual growth rate (CAGR) of approximately 12%. This growth is attributed to the need for reliable data retention and management systems that can handle high-resolution video footage. Consequently, businesses are investing in advanced storage technologies to ensure that critical surveillance data is preserved and accessible, thereby reinforcing the importance of the Video Surveillance Storage Market in contemporary security strategies.

Technological Advancements

Rapid advancements in technology, particularly in video compression and storage solutions, are reshaping the Video Surveillance Storage Market. Innovations such as high-efficiency video coding (HEVC) and cloud storage options enable organizations to store vast amounts of video data more efficiently. The integration of artificial intelligence and machine learning into surveillance systems further enhances the capabilities of storage solutions, allowing for real-time analytics and improved data retrieval. As these technologies evolve, the market is expected to expand, with estimates suggesting a potential increase in market size by 15% over the next five years. This trend indicates a shift towards more sophisticated storage solutions that can accommodate the growing demands of modern surveillance.

Growing Adoption of Smart Cities

The Video Surveillance Storage Industry. As urban areas increasingly integrate technology into their infrastructure, the demand for sophisticated surveillance systems rises. Smart cities require extensive video surveillance to monitor public spaces, traffic, and safety. This necessitates advanced storage solutions capable of handling large volumes of data generated by numerous cameras and sensors. The market is projected to expand as municipalities invest in these technologies, with estimates indicating a potential growth of 20% in the next five years. This trend underscores the critical role of the Video Surveillance Storage Market in supporting the infrastructure of modern urban environments.

Increased Demand for Remote Monitoring

The shift towards remote monitoring solutions is reshaping the Video Surveillance Storage Market. Organizations are increasingly seeking the ability to access surveillance footage from remote locations, driven by the need for flexibility and real-time oversight. This demand is leading to a rise in cloud-based storage solutions that facilitate remote access and management of video data. As businesses and institutions prioritize operational efficiency, the market is expected to grow, with projections indicating a CAGR of 11% over the next few years. This trend highlights the importance of adaptable storage solutions that can meet the evolving needs of users in a dynamic surveillance landscape.