Increasing Security Concerns

The video surveillance-storage market is experiencing growth driven by escalating security concerns across various sectors in the UK. With rising incidents of crime and terrorism, businesses and public institutions are investing heavily in surveillance systems to enhance safety. According to recent data, the UK has seen a 15% increase in security system installations over the past year. This trend indicates a robust demand for video surveillance solutions, which in turn fuels the need for efficient storage systems to manage the vast amounts of data generated. As organizations seek to protect their assets and ensure public safety, the video surveillance-storage market is likely to expand significantly, reflecting the urgency of addressing security challenges.

Growth of Smart City Initiatives

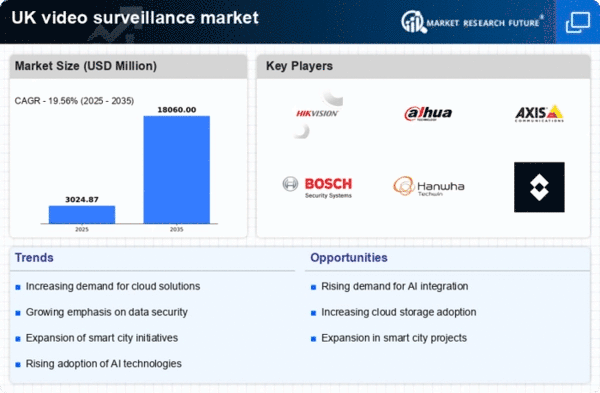

The push towards smart city initiatives in the UK is significantly impacting the video surveillance-storage market. As urban areas become more interconnected, the demand for integrated surveillance systems that can handle large volumes of data is increasing. Local governments are investing in smart technologies to improve public safety and traffic management, which necessitates robust video storage solutions. Reports suggest that the smart city market in the UK is expected to reach £50 billion by 2025, with a substantial portion allocated to surveillance infrastructure. This trend indicates a promising future for the video surveillance-storage market as cities evolve to meet the demands of modern urban living.

Rising Demand for Remote Monitoring

The market is witnessing a surge in demand for remote monitoring capabilities. As businesses and homeowners seek greater control over their security systems, the ability to access video feeds from anywhere has become essential. This trend is particularly pronounced in the retail and residential sectors, where surveillance systems are increasingly integrated with mobile applications. The market for remote monitoring solutions is anticipated to grow by 25% in the coming years, driven by consumer preferences for convenience and real-time access to security footage. Consequently, this demand is likely to propel advancements in storage technologies that support seamless remote access to video data.

Regulatory Pressures on Data Management

Regulatory pressures regarding data management and privacy are shaping the landscape of the video surveillance-storage market. The UK government has implemented stringent regulations that require organizations to manage and store surveillance data responsibly. Compliance with these regulations necessitates the adoption of advanced storage solutions that ensure data integrity and security. As businesses strive to meet these legal requirements, the demand for compliant storage systems is expected to rise. This trend may lead to an increase in investments in video surveillance technologies that not only meet regulatory standards but also enhance overall data management practices.

Technological Advancements in Storage Solutions

Technological innovations are reshaping the video surveillance-storage market, particularly in the realm of data storage solutions. The advent of high-capacity storage devices and advanced compression technologies allows for the efficient management of video data. For instance, the introduction of Network Video Recorders (NVRs) has revolutionized how video footage is stored and retrieved. The market for NVRs is projected to grow by 20% annually, driven by the increasing need for reliable and scalable storage options. These advancements not only enhance the performance of surveillance systems but also reduce operational costs, making them attractive to businesses looking to optimize their security investments.