Increasing Security Concerns

The rising concerns regarding security and safety in the GCC region are driving the demand for the video surveillance-storage market. As urbanization accelerates, cities are becoming more vulnerable to crime and terrorism. Consequently, governments and private entities are investing heavily in surveillance systems to enhance public safety. The is projected to grow at a CAGR of approximately 12% from 2025 to 2030., reflecting the urgency to implement robust security measures. This trend is particularly evident in critical infrastructure sectors such as transportation, healthcare, and education, where surveillance systems are deemed essential for risk mitigation. The increasing need for real-time monitoring and data storage solutions is likely to propel the market further, as stakeholders seek to ensure the safety of their assets and personnel.

Government Initiatives and Funding

Government initiatives aimed at enhancing public safety and security are playing a pivotal role in the growth of the video surveillance-storage market. Various GCC governments are allocating substantial budgets to improve surveillance infrastructure, particularly in urban areas. For example, initiatives such as smart city projects are integrating advanced surveillance systems to monitor public spaces effectively. The video surveillance-storage market is likely to benefit from these investments, as they create opportunities for technology providers to offer innovative solutions. Additionally, public-private partnerships are emerging, where governments collaborate with private firms to deploy surveillance technologies. This trend not only boosts market growth but also fosters innovation in storage solutions, as stakeholders seek to meet the evolving demands of security and data management.

Rising Demand for Smart Surveillance Systems

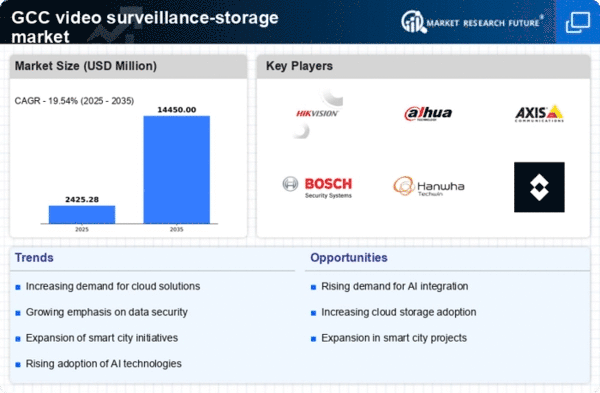

The increasing demand for smart surveillance systems is a key driver of the video surveillance-storage market. As businesses and governments in the GCC region seek to enhance their security measures, there is a noticeable shift towards intelligent surveillance solutions that incorporate features such as facial recognition, motion detection, and analytics. These systems require advanced storage capabilities to handle the large volumes of data generated. The market for video surveillance-storage is projected to expand as organizations invest in these smart technologies, which not only improve security but also provide valuable insights for operational efficiency. The integration of Artificial Intelligence (AI) in surveillance systems is expected to further elevate the demand for sophisticated storage solutions, as AI-driven analytics necessitate robust data management capabilities.

Growing Importance of Data Privacy Regulations

The increasing emphasis on data privacy regulations is influencing the video surveillance-storage market. As governments in the GCC region implement stricter data protection laws, organizations are compelled to adopt surveillance solutions that comply with these regulations. This trend is driving the demand for storage systems that ensure data security and privacy, as businesses seek to avoid potential legal repercussions. The video surveillance-storage market is likely to see a rise in demand for encryption technologies and secure storage solutions that align with regulatory requirements. Furthermore, organizations are investing in training and awareness programs to ensure compliance, which may lead to increased spending on advanced storage technologies. This focus on data privacy is expected to shape the future landscape of the market, as stakeholders prioritize secure and compliant surveillance solutions.

Technological Advancements in Storage Solutions

Technological innovations in storage solutions are significantly impacting the video surveillance-storage market. The advent of high-capacity storage devices, such as Network Video Recorders (NVRs) and cloud-based storage systems, has transformed how video data is stored and managed. These advancements allow for the storage of vast amounts of data, accommodating the growing number of surveillance cameras deployed across the GCC. For instance, the integration of Solid State Drives (SSDs) has improved data retrieval speeds and reliability, which is crucial for real-time surveillance applications. The market is expected to witness a shift towards hybrid storage solutions, combining on-premises and cloud storage, which could enhance data accessibility and security. This evolution in storage technology is likely to attract more investments in the video surveillance-storage market, as organizations seek efficient and scalable solutions.