Increasing Security Concerns

In Japan, the rising concerns regarding security and safety are significantly influencing the video surveillance-storage market. With urbanization and population density increasing, the need for effective surveillance systems has become paramount. Incidents of crime and public safety threats have prompted both public and private sectors to invest in advanced surveillance technologies. The market is expected to witness a surge in demand for storage solutions that can handle large volumes of video data generated by these systems. According to recent estimates, the market could reach a valuation of over $1 billion by 2027, reflecting a growing recognition of the importance of surveillance in maintaining public safety. This heightened awareness is likely to propel the video surveillance-storage market forward in Japan.

Government Initiatives and Funding

Government initiatives aimed at enhancing public safety and security are playing a crucial role in shaping the video surveillance-storage market. Various local and national programs are being implemented to promote the adoption of advanced surveillance technologies. Funding for smart city projects, which often include extensive surveillance systems, is increasing. This financial support encourages municipalities and businesses to invest in video surveillance solutions, thereby driving demand for effective storage options. The government’s commitment to improving urban safety is expected to result in a market growth rate of around 7% annually, as more entities seek to comply with safety regulations and enhance their surveillance capabilities. Such initiatives are likely to have a lasting impact on the video surveillance-storage market.

Growth of E-commerce and Retail Security

The expansion of e-commerce in Japan is significantly impacting the video surveillance-storage market. As online shopping continues to grow, brick-and-mortar retailers are increasingly investing in surveillance systems to protect their physical stores and inventory. The need for enhanced security measures to prevent theft and ensure customer safety is driving demand for advanced video storage solutions. Retailers are looking for systems that can provide high-quality video footage and efficient data management. It is estimated that the retail sector will account for approximately 30% of the total market share by 2026, highlighting the importance of surveillance in maintaining security in a competitive landscape. This trend suggests a promising outlook for the video surveillance-storage market.

Integration of IoT in Surveillance Systems

The integration of Internet of Things (IoT) technology into surveillance systems is emerging as a key driver for the video surveillance-storage market. IoT-enabled devices allow for seamless connectivity and data sharing between surveillance cameras and storage solutions. This connectivity enhances the efficiency of data management and retrieval processes, making it easier for organizations to monitor and analyze video feeds. The growing trend of smart homes and businesses is further propelling the demand for integrated surveillance solutions. Analysts predict that the market could see a growth rate of around 9% over the next few years, as more entities recognize the benefits of IoT in enhancing security measures. This integration is likely to redefine the landscape of the video surveillance-storage market.

Technological Advancements in Surveillance Systems

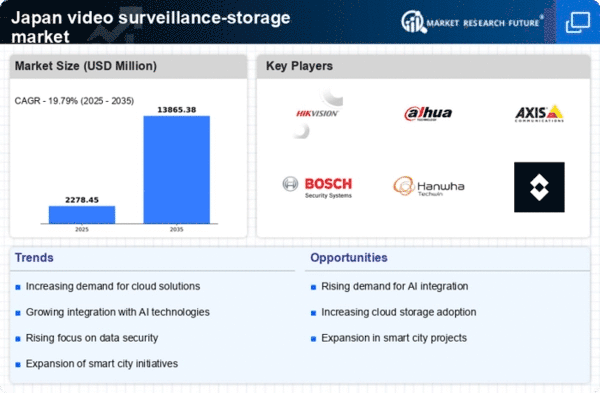

The video surveillance-storage market is experiencing a notable transformation due to rapid technological advancements. Innovations in high-definition cameras, video analytics, and artificial intelligence are enhancing the capabilities of surveillance systems. These advancements enable more efficient data storage and retrieval, which is crucial for businesses and public safety organizations. The integration of smart technologies allows for real-time monitoring and analysis, thereby increasing the demand for sophisticated storage solutions. As a result, the market is projected to grow at a CAGR of approximately 8% over the next five years, driven by the need for enhanced security measures across various sectors, including retail, transportation, and critical infrastructure. This trend indicates a robust future for the video surveillance-storage market in Japan.