Top Industry Leaders in the Video Surveillance Storage Market

Competitive Landscape of the Video Surveillance Storage Market

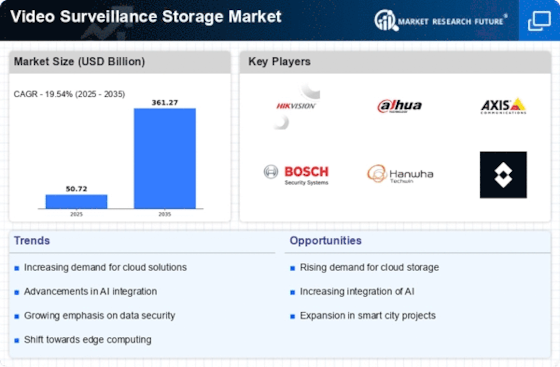

The video surveillance storage market, projected to reach a staggering 27.6 billion USD by 2031, is witnessing a dynamic and fragmented landscape. A diverse mix of established players and nimble newcomers vie for market share, employing distinct strategies and catering to differentiated segments. In this 1000-word exploration, we delve into the competitive arena, analyzing key players, their tactics, and the factors shaping their success.

Key Players:

- Cisco Systems (U.S.)

- Dell (U.S.)

- Hitachi Ltd. (Japan)

- Seagate Technology LLC (U.S.)

- NetApp (U.S.)

- Robert Bosch GmbH (Germany)

- Honeywell International Inc. (U.S.)

- Avigilon Corporation (Canada)

- Schneider Electric SE (France)

Factors Shaping Market Share Analysis:

- Product Portfolio: The breadth and depth of storage solutions offered, encompassing hardware, software, and cloud options, is crucial. Players must cater to diverse storage needs, from edge recording to central archiving.

- Technology Innovation: Embracing advancements like AI-powered video analytics, edge computing, and data compression technologies differentiates players, offering performance and efficiency gains.

- Regional Focus: Geographical expansion strategies play a pivotal role. Understanding regional regulations, security concerns, and infrastructure limitations is key to success in international markets.

- Partnerships and Acquisitions: Strategic partnerships with camera manufacturers, software vendors, and system integrators broaden a player's reach and expertise. Acquisitions can accelerate technology access and market penetration.

- Pricing and Customer Service: Cost-competitiveness while maintaining quality and offering top-notch customer service is critical. Providing robust technical support and post-sales assistance builds customer loyalty.

Emerging Stars and Their Disruptive Potential:

- Start-ups: Nimble, innovative start-ups like Verkada and Milestone Systems are shaking up the market with cloud-based, subscription-model video surveillance solutions. Their user-friendly platforms and affordable pricing attract small and medium-sized businesses.

- Cybersecurity Companies: Cybersecurity players like MacAfee and Palo Alto Networks are entering the fray, offering video surveillance storage solutions integrated with their broader security suite. Their focus on data security and threat detection appeals to security-conscious organizations.

Investment Trends Driving Future Growth:

- Artificial Intelligence (AI): Integration of AI-powered video analytics for object detection, anomaly recognition, and proactive security measures is a major investment focus.

- Edge Computing: Development of intelligent edge storage devices that analyze data on-site, reducing bandwidth and cloud storage costs, is gaining traction.

- Cybersecurity: Enhanced data encryption, access control, and threat detection features are being prioritized to address vulnerabilities in video surveillance systems.

- Cloud & Hybrid Deployment: Flexible cloud-based storage solutions alongside hybrid models offering on-premises and cloud integration are catering to diverse customer preferences.

Latest Company Updates:

October 26, 2023: Seagate announces its Exos X18 enterprise hard drive optimized for large-scale video surveillance systems, offering high capacity and reliability

December 5, 2023: Dell EMC unveils its Power Store X storage appliance with integrated video surveillance storage capabilities, targeting mid-sized enterprises.

December 12, 2023: Google Cloud announces availability of its Video Intelligence API for anomaly detection and object recognition in video footage, aiming to enhance security applications,

January 10, 2024: Microsoft Azure and Milestone Systems partner to offer a cloud-based video surveillance solution for large-scale deployments, combining Azure's cloud infrastructure with Milestone's management software.