Regulatory Framework

The evolving regulatory landscape is shaping the Usage-Based Car Insurance Market significantly. Governments are increasingly recognizing the benefits of usage-based models, which promote safer driving habits and potentially lower accident rates. In many regions, regulatory bodies are encouraging insurers to adopt telematics-based policies, which can lead to reduced premiums for low-risk drivers. This regulatory support is likely to foster a more competitive market environment, as insurers innovate to comply with new standards. As of 2025, several countries have implemented favorable regulations that facilitate the growth of usage-based insurance, suggesting a trend towards broader acceptance and integration of these models in the insurance sector.

Technological Advancements

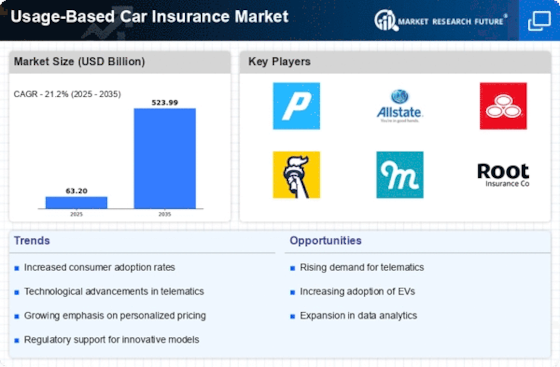

The rapid evolution of telematics technology is a primary driver for the Usage-Based Car Insurance Market. With advancements in GPS and mobile applications, insurers can now collect real-time data on driving behavior, including speed, braking patterns, and mileage. This data enables insurers to offer personalized premiums based on individual risk profiles, which can lead to more competitive pricing. As of 2025, it is estimated that the telematics segment within the insurance industry could reach a valuation of over 20 billion dollars, indicating a robust growth trajectory. The integration of artificial intelligence and machine learning further enhances data analysis capabilities, allowing for more accurate risk assessments and tailored insurance products.

Cost Efficiency for Insurers

Cost efficiency is emerging as a crucial driver for the Usage-Based Car Insurance Market. Insurers are increasingly recognizing that usage-based models can lead to reduced claims costs and improved profitability. By leveraging telematics data, insurers can more accurately assess risk and minimize fraudulent claims, which can significantly lower operational costs. Furthermore, the ability to offer competitive pricing based on actual driving behavior can attract a broader customer base, enhancing market share. As of 2025, it is projected that insurers adopting usage-based models could see a reduction in claims costs by up to 15%, indicating a strong financial incentive for companies to transition towards this innovative insurance approach.

Consumer Demand for Personalization

There is a growing consumer demand for personalized insurance products, which is driving the Usage-Based Car Insurance Market. Modern consumers are increasingly seeking insurance solutions that reflect their individual driving habits and lifestyle choices. This shift towards personalization is evident in the rising popularity of pay-as-you-drive models, where premiums are directly linked to actual driving behavior. Market data indicates that approximately 30% of consumers express interest in usage-based insurance options, highlighting a significant opportunity for insurers to cater to this demand. As consumers become more aware of the potential savings associated with usage-based policies, the market is likely to expand further, encouraging insurers to innovate and enhance their offerings.

Increased Competition Among Insurers

The rise of usage-based insurance is fostering increased competition among insurers within the Usage-Based Car Insurance Market. As more companies enter the market with innovative telematics solutions, existing insurers are compelled to enhance their offerings to retain customers. This competitive landscape is likely to drive down premiums and improve service quality, benefiting consumers. Market analysis suggests that the number of insurers offering usage-based policies has doubled in recent years, reflecting a shift in industry dynamics. As competition intensifies, insurers may invest more in technology and customer engagement strategies, further propelling the growth of the usage-based insurance segment.