Government Incentives and Funding

Government incentives play a pivotal role in shaping the wireless electric-vehicle-charging market. Various federal and state programs are designed to promote the adoption of electric vehicles and the development of charging infrastructure. In 2025, the US government has allocated approximately $7 billion to support EV charging initiatives, which includes funding for wireless charging technologies. These incentives not only lower the cost barrier for consumers but also encourage manufacturers to invest in innovative charging solutions. The wireless electric-vehicle-charging market stands to gain from these initiatives, as they create a favorable environment for technological advancements and increased consumer acceptance.

Advancements in Charging Infrastructure

The expansion of charging infrastructure is a crucial factor influencing the wireless electric-vehicle-charging market. As more charging stations are installed across urban and suburban areas, the convenience of charging EVs increases, thereby encouraging adoption. By 2025, the US is expected to have over 100,000 public charging stations, a significant increase from previous years. This growth in infrastructure supports the wireless electric-vehicle-charging market by providing the necessary framework for widespread adoption. Furthermore, the integration of wireless charging technology into existing infrastructure could enhance user experience, making it more appealing for consumers to transition to electric vehicles.

Growing Demand for Sustainable Transportation

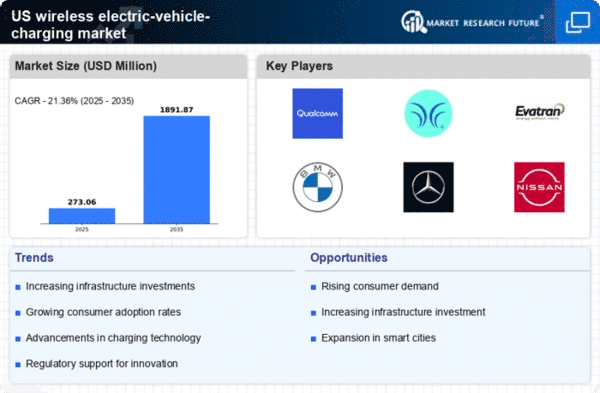

The increasing emphasis on sustainable transportation solutions is a primary driver for the wireless electric-vehicle-charging market. As consumers become more environmentally conscious, the demand for electric vehicles (EVs) is surging. In 2025, EV sales in the US are projected to reach approximately 1.5 million units, representing a growth of around 30% from the previous year. This shift towards EVs necessitates the development of efficient charging solutions, including wireless technology. The wireless electric-vehicle-charging market is poised to benefit from this trend, as it offers a convenient and eco-friendly alternative to traditional charging methods, aligning with the broader goals of reducing carbon emissions and promoting renewable energy sources.

Rising Urbanization and Smart City Initiatives

The trend of rising urbanization and the development of smart city initiatives are significant drivers for the wireless electric-vehicle-charging market. As urban populations grow, the demand for efficient transportation solutions increases. Smart city projects often incorporate advanced technologies, including wireless charging systems, to enhance urban mobility. By 2025, it is estimated that over 60% of the US population will reside in urban areas, creating a pressing need for innovative charging solutions. The wireless electric-vehicle-charging market is well-positioned to capitalize on this trend, as cities look to integrate sustainable transportation options into their infrastructure, thereby improving overall urban mobility.

Technological Innovations in Wireless Charging

Technological innovations are driving the evolution of the wireless electric-vehicle-charging market. Recent advancements in resonant inductive charging and magnetic resonance technology have improved the efficiency and effectiveness of wireless charging systems. In 2025, the efficiency of wireless charging systems is expected to exceed 90%, making them a viable alternative to traditional charging methods. These innovations not only enhance the user experience but also address concerns regarding charging speed and energy loss. As technology continues to advance, the wireless electric-vehicle-charging market is likely to see increased adoption rates, as consumers seek more efficient and convenient charging solutions.