Government Incentives and Policies

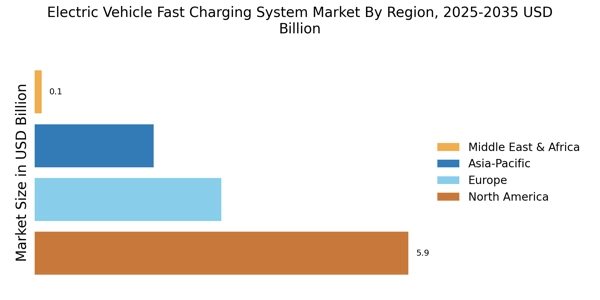

Government incentives and policies play a crucial role in shaping the Electric Vehicle Fast Charging System Market. Many countries have introduced various financial incentives, such as tax credits, rebates, and grants, to encourage the adoption of electric vehicles and the development of charging infrastructure. For instance, in 2025, several nations are expected to allocate significant budgets to enhance EV infrastructure, with projections indicating a potential investment of over 10 billion dollars in fast charging networks. These initiatives not only stimulate demand for electric vehicles but also create a favorable environment for the expansion of fast charging systems. As governments continue to prioritize sustainability, the Electric Vehicle Fast Charging System Market is likely to experience accelerated growth.

Expansion of Charging Infrastructure

The expansion of charging infrastructure is a vital driver for the Electric Vehicle Fast Charging System Market. As the number of electric vehicles increases, the demand for accessible and reliable charging stations becomes paramount. In 2025, it is projected that the number of public charging stations will reach over 1 million globally, facilitating the widespread adoption of electric vehicles. This expansion is driven by both private and public investments, with many companies and municipalities recognizing the importance of a comprehensive charging network. The availability of fast charging stations not only alleviates range anxiety among consumers but also encourages more individuals to transition to electric vehicles, thereby fostering growth in the Electric Vehicle Fast Charging System Market.

Collaborative Partnerships and Alliances

Collaborative partnerships and alliances among various stakeholders are increasingly influencing the Electric Vehicle Fast Charging System Market. Automakers, charging network providers, and technology companies are joining forces to develop integrated solutions that enhance the charging experience for consumers. In 2025, numerous partnerships are expected to emerge, focusing on the development of standardized charging protocols and interoperability among different charging systems. These collaborations not only streamline the charging process but also promote the establishment of a cohesive charging ecosystem. As stakeholders work together to address common challenges, the Electric Vehicle Fast Charging System Market is likely to benefit from increased innovation and a more robust infrastructure.

Increasing Adoption of Electric Vehicles

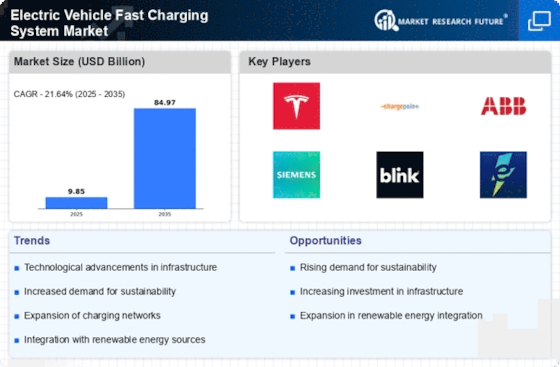

The rising adoption of electric vehicles (EVs) is a primary driver for the Electric Vehicle Fast Charging System Market. As consumers become more environmentally conscious and governments implement stricter emissions regulations, the demand for EVs continues to surge. In 2025, it is estimated that the number of electric vehicles on the road will exceed 30 million units, significantly increasing the need for efficient charging solutions. This growing fleet of EVs necessitates the establishment of a robust fast charging infrastructure, which in turn propels the market for fast charging systems. The shift towards electric mobility is not merely a trend; it represents a fundamental change in transportation, thereby creating a substantial opportunity for stakeholders in the Electric Vehicle Fast Charging System Market.

Technological Innovations in Charging Solutions

Technological innovations are transforming the Electric Vehicle Fast Charging System Market. Advancements in charging technology, such as ultra-fast charging and wireless charging solutions, are enhancing the efficiency and convenience of charging electric vehicles. In 2025, the introduction of new charging standards and improved battery technologies is expected to reduce charging times significantly, making EVs more appealing to consumers. Furthermore, the integration of smart grid technology allows for better energy management and optimization of charging stations. These innovations not only improve user experience but also contribute to the overall growth of the Electric Vehicle Fast Charging System Market, as they address key concerns related to charging speed and accessibility.