Rise of Electric Vehicles

The In-Vehicle Wireless Charging Market is experiencing a notable rise due to the increasing adoption of electric vehicles (EVs). As more consumers transition to EVs, the demand for efficient and convenient charging solutions is escalating. The market for electric vehicles is projected to reach over 30 million units by 2030, which will likely drive the need for innovative charging technologies. Wireless charging systems offer a unique solution that aligns with the lifestyle of EV owners, providing a hassle-free way to charge their vehicles. This trend is further supported by advancements in battery technology, which enhance the overall performance and range of electric vehicles, making them more appealing to a broader audience.

Regulatory Support and Standards

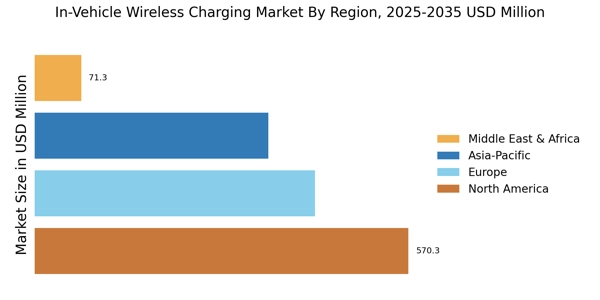

The In-Vehicle Wireless Charging Market is bolstered by increasing regulatory support and the establishment of industry standards. Governments are recognizing the importance of sustainable transportation solutions, leading to the implementation of policies that encourage the adoption of electric vehicles and associated technologies. For instance, various countries are setting ambitious targets for electric vehicle sales, which indirectly supports the wireless charging market. The establishment of universal standards for wireless charging systems is also crucial, as it ensures compatibility across different vehicle models and manufacturers. This regulatory framework is expected to foster innovation and investment in the market, potentially leading to a more robust infrastructure for wireless charging solutions.

Integration of Smart Technologies

The In-Vehicle Wireless Charging Market is increasingly influenced by the integration of smart technologies within vehicles. As vehicles become more connected and equipped with advanced infotainment systems, the demand for wireless charging solutions is expected to rise. Smart technologies, such as vehicle-to-grid communication and IoT connectivity, are enhancing the functionality of wireless charging systems, allowing for more efficient energy management. This integration not only improves the user experience but also aligns with the growing trend of smart cities and sustainable transportation solutions. As automakers continue to innovate and incorporate these technologies, the wireless charging market is likely to expand, offering consumers more sophisticated and efficient charging options.

Consumer Demand for Enhanced Convenience

The In-Vehicle Wireless Charging Market is significantly influenced by the growing consumer demand for enhanced convenience in vehicle technology. As consumers increasingly seek seamless integration of technology in their daily lives, the ability to charge devices without the hassle of cables becomes a compelling selling point. Surveys indicate that a substantial percentage of consumers prioritize convenience features when purchasing vehicles, with wireless charging emerging as a preferred option. This trend is particularly evident among younger demographics who are more inclined to adopt new technologies. Consequently, automakers are responding by incorporating wireless charging capabilities into their vehicles, thereby driving market growth and expanding the range of available options for consumers.

Technological Advancements in Charging Solutions

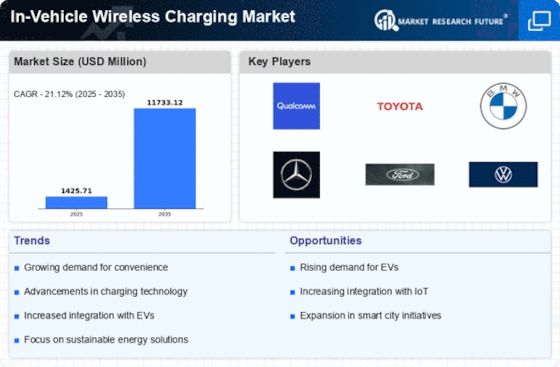

The In-Vehicle Wireless Charging Market is experiencing a surge in technological advancements that enhance the efficiency and convenience of charging solutions. Innovations such as resonant inductive charging and magnetic resonance technology are paving the way for more effective power transfer. These advancements not only improve charging speeds but also reduce energy loss during the process. As a result, the market is projected to grow at a compound annual growth rate of approximately 25% over the next five years. This growth is driven by the increasing integration of electric vehicles and the demand for seamless charging experiences. Furthermore, advancements in battery technology are likely to complement these charging solutions, making them more appealing to consumers and manufacturers alike.