Partnerships and Collaborations

Strategic partnerships between automotive manufacturers and technology firms are emerging as a crucial driver for the in vehicle-wireless-charging market. Collaborations aimed at developing and implementing wireless charging solutions are becoming more common, as companies recognize the potential for innovation in this space. For instance, partnerships between automakers and tech companies can facilitate the integration of advanced wireless charging systems into new vehicle models. This collaborative approach not only accelerates technological advancements but also enhances the overall consumer experience. In 2025, it is anticipated that at least 15% of new vehicle models will feature wireless charging capabilities, reflecting the growing interest in this technology. Such partnerships are likely to foster a competitive landscape, encouraging further investment and research in the in vehicle-wireless-charging market, ultimately benefiting consumers with more options and improved technologies.

Consumer Awareness and Education

As awareness regarding the benefits of wireless charging technology grows, the in vehicle-wireless-charging market is poised for expansion. Educational initiatives aimed at informing consumers about the advantages of wireless charging, such as convenience and reduced wear on charging ports, are becoming increasingly prevalent. Surveys indicate that approximately 60% of consumers express interest in wireless charging solutions for their vehicles, suggesting a significant market potential. This heightened awareness is likely to drive demand for in vehicle-wireless-charging systems, as consumers seek to adopt technologies that simplify their daily routines. Additionally, as more automakers incorporate wireless charging capabilities into their vehicles, consumer familiarity with the technology is expected to increase, further propelling market growth. The in vehicle-wireless-charging market may thus experience a surge in adoption rates as consumers become more informed and receptive to innovative charging solutions.

Integration of Electric Vehicles

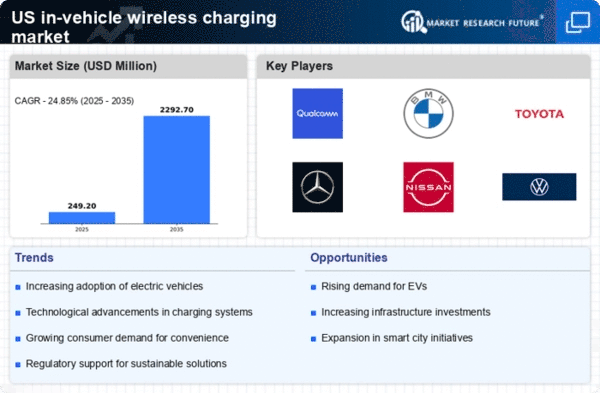

The increasing adoption of electric vehicles (EVs) in the US is a pivotal driver for the in vehicle-wireless-charging market. As consumers shift towards EVs, the demand for efficient charging solutions rises. In 2025, EV sales are projected to account for approximately 25% of total vehicle sales in the US, indicating a substantial market opportunity. This trend necessitates the development of innovative charging technologies, including wireless options, to enhance user experience and convenience. The in vehicle-wireless-charging market is likely to benefit from this transition, as manufacturers seek to provide seamless charging solutions that align with consumer preferences for technology and sustainability. Furthermore, the integration of wireless charging systems into EVs could potentially reduce the reliance on traditional charging infrastructure, thereby streamlining the charging process and enhancing the overall appeal of electric vehicles.

Government Initiatives and Funding

Government initiatives aimed at promoting clean energy and sustainable transportation are significantly influencing the in vehicle-wireless-charging market. Various federal and state programs are providing funding and incentives for the development of innovative charging technologies, including wireless solutions. In 2025, it is estimated that government funding for EV infrastructure will exceed $5 billion, with a portion allocated specifically for wireless charging projects. This financial support is likely to stimulate research and development efforts within the in vehicle-wireless-charging market, encouraging companies to innovate and enhance their offerings. Furthermore, as regulatory frameworks evolve to support the adoption of electric vehicles, the demand for efficient charging solutions, such as wireless charging, is expected to increase. This alignment of government objectives with market needs could create a favorable environment for the growth of the in vehicle-wireless-charging market.

Technological Innovations in Charging Systems

The continuous evolution of charging technologies is a fundamental driver for the in vehicle-wireless-charging market. Innovations such as resonant inductive charging and magnetic resonance technology are paving the way for more efficient and effective wireless charging solutions. These advancements not only improve charging efficiency but also enhance the user experience by reducing charging times and increasing convenience. In 2025, it is projected that the efficiency of wireless charging systems will reach approximately 90%, making them a viable alternative to traditional charging methods. As these technologies mature, the in vehicle-wireless-charging market is likely to witness increased adoption rates, as consumers and manufacturers alike recognize the benefits of integrating advanced charging systems into vehicles. The potential for further innovations in this field suggests a dynamic and rapidly evolving market landscape.