Government Incentives and Policies

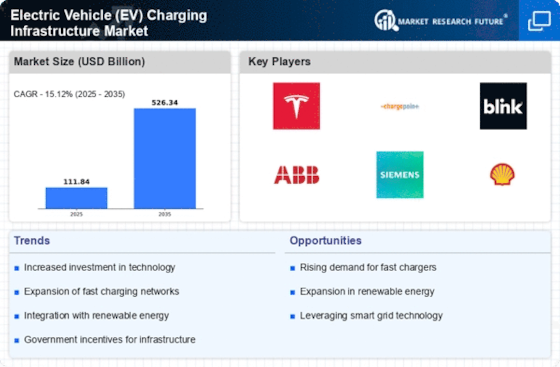

The Electric Vehicle (EV) Charging Infrastructure Market is experiencing a surge in growth due to favorable government incentives and policies. Various governments are implementing tax credits, rebates, and grants to encourage the installation of EV charging stations. For instance, some regions have allocated substantial budgets to enhance charging infrastructure, aiming to support the transition to electric mobility. This financial backing not only reduces the initial investment burden for businesses and consumers but also stimulates demand for electric vehicles. As a result, the market is projected to expand significantly, with estimates suggesting that the number of charging stations could double in the next few years, thereby enhancing accessibility and convenience for EV users.

Corporate Sustainability Initiatives

The Electric Vehicle (EV) Charging Infrastructure Market is benefiting from the growing emphasis on corporate sustainability initiatives. Many companies are adopting environmentally friendly practices, including the transition to electric fleets and the installation of EV charging stations at their facilities. This shift is driven by both regulatory pressures and consumer expectations for corporate responsibility. As businesses invest in charging infrastructure, they not only enhance their sustainability profiles but also contribute to the overall growth of the EV charging market. Reports indicate that a considerable number of corporations are planning to install charging stations in the coming years, which could lead to a substantial increase in the availability of charging options for consumers.

Urbanization and Infrastructure Development

The Electric Vehicle (EV) Charging Infrastructure Market is significantly influenced by ongoing urbanization and infrastructure development. As urban areas expand, the demand for efficient transportation solutions, including electric vehicles, is on the rise. This urban growth necessitates the establishment of comprehensive charging networks to support the increasing number of EVs on the road. City planners and developers are recognizing the importance of integrating charging stations into new developments and public spaces. Consequently, this trend is likely to drive the expansion of charging infrastructure, with projections indicating a marked increase in the number of charging points in urban centers over the next few years, thereby facilitating the adoption of electric vehicles.

Rising Consumer Demand for Electric Vehicles

The Electric Vehicle (EV) Charging Infrastructure Market is closely linked to the increasing consumer demand for electric vehicles. As more individuals and businesses recognize the environmental benefits and cost savings associated with EVs, the need for a robust charging infrastructure becomes paramount. Recent surveys indicate that a significant percentage of potential car buyers prioritize access to charging stations when considering an electric vehicle purchase. This trend is likely to drive investments in charging infrastructure, as manufacturers and service providers seek to meet consumer expectations. Consequently, the market may witness a rapid expansion, with projections indicating a potential increase in charging stations to accommodate the growing EV population.

Technological Advancements in Charging Solutions

The Electric Vehicle (EV) Charging Infrastructure Market is being propelled by rapid technological advancements in charging solutions. Innovations such as ultra-fast charging stations and wireless charging technologies are enhancing the efficiency and convenience of EV charging. These advancements not only reduce charging times but also improve the overall user experience, making electric vehicles more appealing to consumers. Furthermore, the integration of smart technology allows for better energy management and grid integration, which is crucial for the sustainability of charging networks. As these technologies continue to evolve, the market is expected to grow, with estimates suggesting a significant increase in the adoption of advanced charging solutions over the next few years.

Leave a Comment