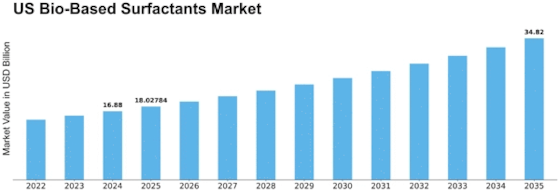

Us Bio Based Surfactants Size

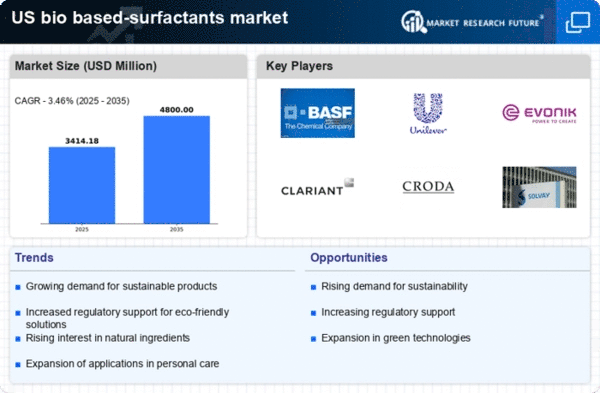

US Bio-based surfactants Market Growth Projections and Opportunities

Various market influences have contributed significantly to the growth and development of the US Bio-based Surfactants Market. One major driver of this market is the increasing concern for environmental sustainability. On the other hand, consumers and industries understand that they need eco-friendly substitutes hence bio-based surfactants from renewable resources are becoming popular because they are less harmful to nature than traditional surfactants. This growing consciousness has increased the demand for bio-based surfactants in various sectors such as personal care products and industrial cleaning solutions.

The government rules also form part of shaping the US Bio-based Surfactants Market. Therefore, policy-making focus is shifting towards sustainability due to concerns over environmental issues leading to an urge of promoting and encouraging bio-based products. For instance, green procurement policies, together with renewable energy standards among others initiatives by governments have created a favorable environment for adoption of such surfactants. Through providing this regulatory support, not only does it help in growing markets but also assists in spurring innovations in new and better formulations for bio-based surfactants.

Consumer preferences have evolved with more people desiring products that meet their needs on sustainability and health basis. Considering their environmentally friendly nature since they come from natural sources, bio-based surfactants appeal greatly to eco conscious customers. Manufacturers’ changing mindsets are contributing to the integration of these substances into their formulas thereby driving up market size. The requirement for biodegradable materials that are eco-friendly will continue dictating changes within US Bio-based Surfactant Markets.

Market forces are shaped by technological advances plus R&D activities. In order to make these surfactant production process competitive, continuous efforts should be made to improve its efficiency while reducing costs. By exploring alternative feedstocks along with advanced manufacturing processes one can increase performance characteristics making them better alternatives compared to conventional types of surfactants. Consequently, becoming acquainted with such technological advancements is crucial if one intends retain his position within the market and meet the changing needs of many industries.

The success in US Bio-based Surfactants Market depends on supply chain considerations such as raw materials availability and logistical efficiencies. Strategic sourcing of renewable feedstocks for making bio-based surfactants is necessary to ensure a sustainable and secure supply chain. In addition, efficient logistics and distribution networks are crucial in meeting the growing demand for bio-based surfactants across diverse sectors.

In this way, market dynamics change through collaboration and partnerships. It is through these collaborations that knowledge becomes shared between research centers, producers and end users leading to innovations in new applications of bio-based surfactants. Additionally, by leveraging on each other’s’ strengths at different stages of production strategic alliances bring about expansion thus increase market size.

Leave a Comment