Regulatory Support

Regulatory frameworks promoting the use of bio-based chemicals are likely to enhance the Global Synthetic and Bio-based Aniline Market. Governments worldwide are implementing policies that encourage the adoption of sustainable practices, including the use of bio-based aniline. These regulations often provide incentives for companies to transition from synthetic to bio-based materials, thereby fostering innovation and investment in the sector. For example, initiatives aimed at reducing greenhouse gas emissions are pushing manufacturers to explore alternative sources of aniline. As a result, the market for bio-based aniline is expected to gain traction, potentially capturing a larger share of the overall aniline market. This regulatory support could be pivotal in shaping future market dynamics.

Technological Innovations

Technological advancements in production processes are reshaping the Global Synthetic and Bio-based Aniline Market. Innovations such as improved catalytic processes and more efficient extraction methods are enhancing the yield and purity of aniline. These advancements not only reduce production costs but also minimize waste, aligning with the industry's sustainability goals. For instance, the introduction of green chemistry principles in aniline production has the potential to significantly lower hazardous by-products. Market data suggests that companies investing in these technologies may experience a competitive edge, as they can offer higher quality products at lower prices. This trend indicates a promising future for both synthetic and bio-based aniline, as technology continues to evolve.

Sustainability Initiatives

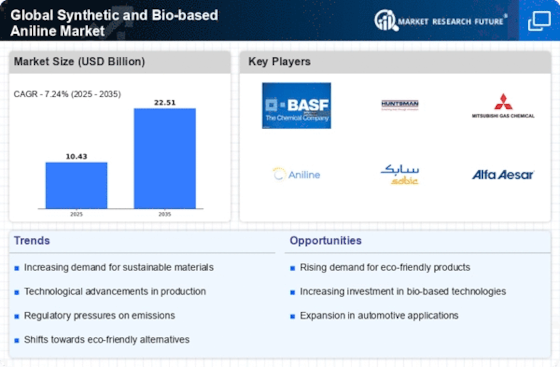

The increasing emphasis on sustainability within the chemical industry appears to drive the demand for bio-based aniline. As consumers and manufacturers alike prioritize eco-friendly products, the Global Synthetic and Bio-based Aniline Market is witnessing a shift towards renewable resources. This transition is not merely a trend but a fundamental change in production practices, with bio-based aniline offering a lower carbon footprint compared to its synthetic counterpart. Reports indicate that the bio-based segment is projected to grow at a compound annual growth rate (CAGR) of approximately 8% over the next five years. This growth is likely fueled by regulatory frameworks and consumer preferences that favor sustainable materials, thereby enhancing the market's overall appeal.

Diverse Industrial Applications

The versatility of aniline in various industrial applications is a key driver for the Global Synthetic and Bio-based Aniline Market. Aniline is utilized in the production of dyes, pharmaceuticals, and rubber processing chemicals, among others. The demand for high-performance materials in sectors such as automotive and construction is likely to bolster the market. For instance, the automotive industry increasingly relies on aniline-based products for manufacturing durable and efficient components. Market analysis reveals that the demand for aniline in the dye industry alone is expected to reach USD 5 billion by 2026, highlighting the material's critical role across multiple sectors. This diverse applicability suggests a robust and expanding market landscape.

Growing Demand from Emerging Economies

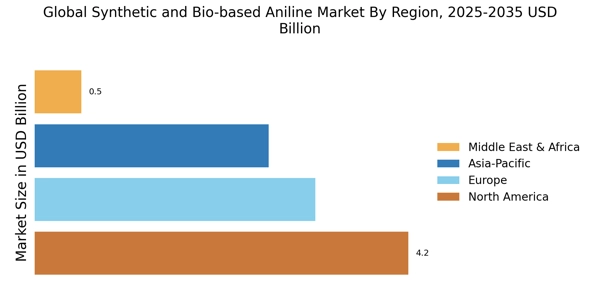

Emerging economies are increasingly contributing to the growth of the Global Synthetic and Bio-based Aniline Market. As these regions industrialize, the demand for aniline-based products is on the rise, driven by expanding manufacturing sectors. Countries in Asia-Pacific, particularly, are witnessing a surge in demand for aniline in various applications, including textiles and automotive components. Market forecasts indicate that the Asia-Pacific region could account for over 40% of the global aniline consumption by 2027. This trend suggests that manufacturers may need to adapt their strategies to cater to the unique needs of these markets, potentially leading to increased production capacities and localized supply chains.