Increased Focus on Preventive Healthcare

The growing emphasis on preventive healthcare is likely to propel the Upper GI Series Market forward. As more individuals prioritize regular health screenings and early detection of gastrointestinal issues, the demand for diagnostic procedures such as the Upper GI Series Market is expected to rise. This trend is supported by public health campaigns that promote awareness of gastrointestinal health and the importance of early intervention. Consequently, healthcare providers are increasingly recommending upper GI imaging as part of routine check-ups, thereby expanding the market. The Upper GI Series Market stands to benefit from this shift towards preventive care, as patients seek proactive measures to maintain their health.

Aging Population and Associated Health Issues

The aging population presents a significant driver for the Upper GI Series Market. As individuals age, they become more susceptible to various gastrointestinal disorders, necessitating regular monitoring and diagnostic evaluations. The demographic shift towards an older population is accompanied by an increase in conditions such as dysphagia and gastrointestinal cancers, which require effective imaging solutions for diagnosis. This demographic trend suggests a sustained demand for upper GI imaging services, as healthcare systems adapt to the needs of an aging populace. The Upper GI Series Market is thus positioned to grow in response to the healthcare demands of older adults, who require comprehensive diagnostic assessments.

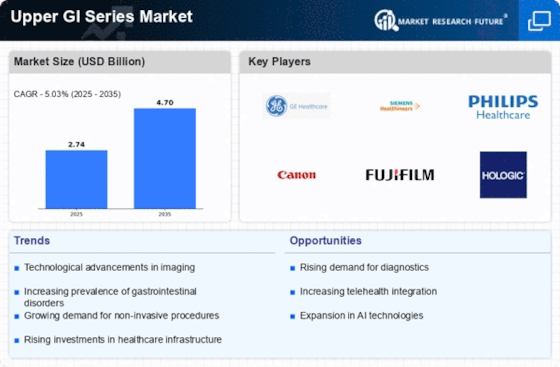

Rising Incidence of Gastrointestinal Disorders

The increasing prevalence of gastrointestinal disorders, such as gastroesophageal reflux disease (GERD) and peptic ulcers, appears to be a primary driver for the Upper GI Series Market. According to recent health statistics, the incidence of these conditions has been on the rise, leading to a greater demand for diagnostic imaging solutions. As healthcare providers seek effective methods to diagnose and monitor these disorders, the Upper GI Series Market becomes a preferred choice due to its ability to provide detailed images of the upper gastrointestinal tract. This trend indicates a growing market potential, as more patients require accurate assessments for timely treatment. The Upper GI Series Market is thus likely to expand in response to this increasing need for diagnostic clarity in gastrointestinal health.

Technological Innovations in Imaging Techniques

Technological advancements in imaging techniques are significantly influencing the Upper GI Series Market. Innovations such as digital radiography and improved fluoroscopy systems enhance the quality and efficiency of upper gastrointestinal imaging. These advancements not only improve diagnostic accuracy but also reduce patient exposure to radiation, addressing safety concerns. The integration of artificial intelligence in image analysis further streamlines the diagnostic process, potentially leading to quicker and more reliable results. As healthcare facilities adopt these cutting-edge technologies, the Upper GI Series Market is expected to experience substantial growth, driven by the demand for enhanced imaging capabilities and improved patient outcomes.

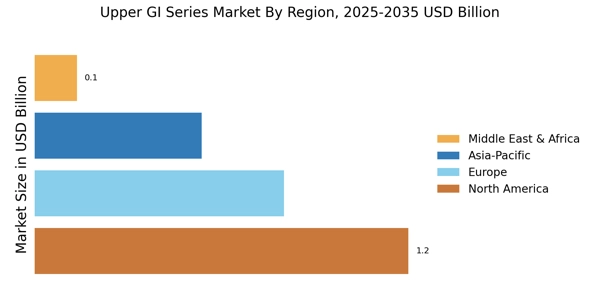

Rising Healthcare Expenditure and Access to Services

The increase in healthcare expenditure across various regions is likely to enhance access to diagnostic services, including the Upper GI Series Market. As governments and private sectors invest more in healthcare infrastructure, the availability of advanced imaging technologies becomes more widespread. This investment facilitates better access to diagnostic procedures for a larger segment of the population, particularly in underserved areas. Furthermore, as patients gain better access to healthcare services, the demand for upper GI imaging is expected to rise, driven by the need for accurate diagnosis and treatment planning. The Upper GI Series Market is thus poised for growth, supported by the overall increase in healthcare spending and improved service accessibility.