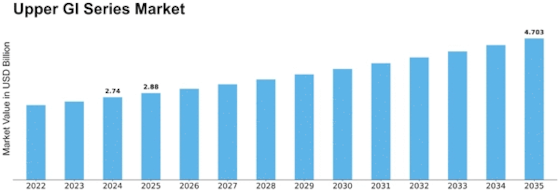

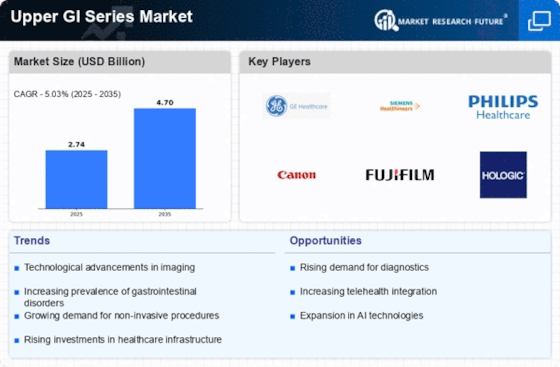

Upper Gi Series Size

Upper GI Series Market Growth Projections and Opportunities

The market factors influencing the Upper Gastrointestinal (GI) Series market encompass a range of elements crucial for healthcare professionals, medical imaging specialists, and pharmaceutical companies. Understanding these factors is essential for navigating the landscape of diagnostic procedures and imaging technologies related to upper GI disorders. The present diagnostic trends in upper GI series may have a tremendous market factor too illustratively. Breakthroughs in image technology like fluoroscopy and digital radiology are also contributing to the increased physician utilization of diagnostic imaging services. Utilization of non-invasive procedures that guarantee accuracy as opposed to the traditional methods by care-givers will increase the market and change the healthcare preference. Now, we all have been aware of the fact that the spread of upper GI disorders is a factor that affects the market for upper GI series. A number of conditions including GERD, A peptic ulcer and esophageal abnormalities that require diagnostic tests account for this need. Watching of the preponderity of these diseases provides a foundation to estimate the amount of demand and the market size. Technology developments that stem from on-going imaging equipment, favor market dynamics. For example, advanced image resolution, 3d reconstruction, and better contrast agents are credited as the innovations that now enable more reliable diagnostic imaging with an upper GI series. This realizes the adoption of these technologies by healthcare facilities causing wave of market trends and competition among manufacturers of the equipment. Patient in-volvement and comfort in the diagnostic medical kits are also of vital significance in the market evaluation points. New procedure programming for patients’ welfare and aided by the cutting-edge technologies minimizes the pain in friendlier upper GI series which enables its adoption. Healthcare suppliers could emphasize gadgets and methods that align to patient experience, thus healthcare providers will give more attention to the goods and services that meet the customers' expectations. The amount of healthcare infrastructure existing in the area goes an important step in determining the availability of upper GI series procedures. Enough facilities, that are fully trained staff and the machinery needed for imaging, compose the marketing landscape. Healthcare infrastructure inequality is the reason of that market flow regionally.

The globalization of healthcare services and the accessibility of advanced diagnostic procedures on a global scale are noteworthy factors. International collaborations, sharing of best practices, and the transfer of technology contribute to the expansion of the upper GI series market beyond national boundaries. Economic factors, including healthcare budgets and spending capacity, influence the market for upper GI series. Affordability of diagnostic procedures, cost-effectiveness, and resource allocation impact the decisions of healthcare providers and patients, shaping market dynamics.

Leave a Comment