Growing Awareness of Preventive Healthcare

The rising awareness of preventive healthcare is a notable driver for the Lower GI Series Market. As individuals become more informed about the importance of early detection of gastrointestinal issues, there is a corresponding increase in demand for diagnostic procedures like lower GI series. Public health campaigns and educational initiatives are encouraging regular screenings, particularly for at-risk populations. This shift towards preventive measures is reflected in the growing number of healthcare facilities offering lower GI series as part of routine check-ups. Consequently, the market is expected to experience growth as more patients seek these diagnostic services to proactively manage their gastrointestinal health.

Regulatory Support and Reimbursement Policies

Regulatory support and favorable reimbursement policies are crucial drivers for the Lower GI Series Market. Governments and health organizations are increasingly recognizing the importance of early diagnosis in managing gastrointestinal diseases, leading to supportive policies that promote the use of lower GI series. Reimbursement for these procedures is becoming more standardized, which encourages healthcare providers to offer them as part of routine diagnostic services. This financial backing not only enhances accessibility for patients but also incentivizes healthcare facilities to invest in the necessary technology and training. As a result, the market for lower GI series is likely to benefit from these supportive regulatory frameworks.

Rising Incidence of Gastrointestinal Disorders

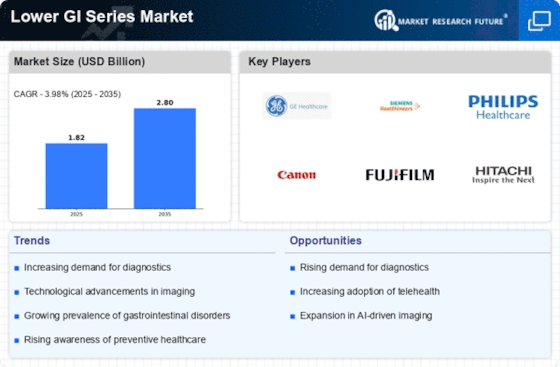

The increasing prevalence of gastrointestinal disorders, such as inflammatory bowel disease and colorectal cancer, appears to be a primary driver for the Lower GI Series Market. According to recent data, the incidence of colorectal cancer has been steadily rising, with estimates suggesting that it could become one of the leading causes of cancer-related deaths. This trend necessitates advanced diagnostic tools, including lower gastrointestinal series, to facilitate early detection and treatment. As healthcare providers seek to address these rising health concerns, the demand for lower GI series procedures is likely to grow, thereby propelling the market forward. Furthermore, the emphasis on timely diagnosis and intervention in gastrointestinal health is expected to enhance the adoption of lower GI series as a standard diagnostic procedure.

Technological Innovations in Imaging Techniques

Technological advancements in imaging techniques are significantly influencing the Lower GI Series Market. Innovations such as digital radiography and improved imaging software have enhanced the accuracy and efficiency of lower GI series procedures. These advancements not only improve diagnostic capabilities but also reduce patient exposure to radiation, which is a critical concern in medical imaging. The integration of artificial intelligence in image analysis is also emerging, potentially streamlining the diagnostic process and improving outcomes. As healthcare facilities increasingly adopt these cutting-edge technologies, the market for lower GI series is likely to expand, driven by the need for more precise and patient-friendly diagnostic options.

Aging Population and Increased Healthcare Expenditure

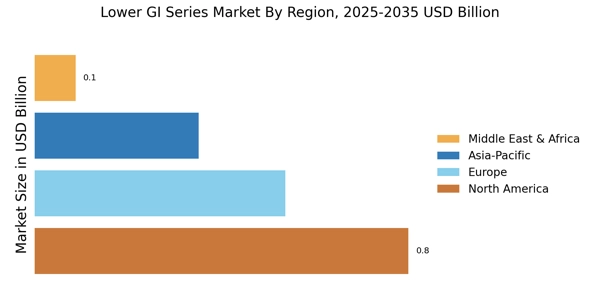

The aging population is a significant factor contributing to the growth of the Lower GI Series Market. As individuals age, the likelihood of developing gastrointestinal disorders increases, leading to a higher demand for diagnostic procedures. Additionally, the rise in healthcare expenditure among older adults facilitates access to advanced diagnostic tools, including lower GI series. Data indicates that healthcare spending is projected to rise, particularly in developed regions, as aging populations seek comprehensive healthcare services. This trend is likely to bolster the market for lower GI series, as healthcare providers aim to meet the diagnostic needs of an increasingly elderly demographic.