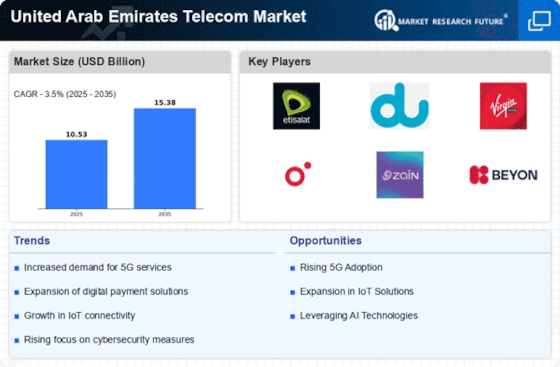

Rising Demand for Mobile Data Services

The United Arab Emirates Telecom Market is currently experiencing a notable surge in demand for mobile data services. This trend is largely driven by the increasing penetration of smartphones and the growing reliance on mobile applications for various daily activities. As of October 2025, mobile data consumption in the UAE has reached unprecedented levels, with reports indicating an average monthly data usage per user exceeding 20 GB. This rising demand compels telecom operators to enhance their infrastructure and invest in advanced technologies to ensure seamless connectivity. Consequently, the competitive landscape is intensifying, as providers strive to offer attractive data packages and superior service quality to capture a larger market share. The ongoing digital transformation across sectors further amplifies this demand, positioning mobile data services as a critical component of the United Arab Emirates Telecom Market.

Expansion of Fiber Optic Infrastructure

The expansion of fiber optic infrastructure is a crucial driver in the United Arab Emirates Telecom Market, facilitating high-speed internet access and enhancing overall connectivity. As of October 2025, the UAE has made significant strides in deploying fiber optic networks, with coverage reaching over 90% of households. This extensive infrastructure development is essential for supporting the increasing demand for high-bandwidth applications, such as streaming services and online gaming. Telecom operators are investing heavily in upgrading their networks to fiber optics, which not only improves service quality but also enables the introduction of innovative services. The ongoing expansion of fiber optic infrastructure is likely to play a vital role in sustaining the growth trajectory of the United Arab Emirates Telecom Market, as it aligns with the nation's vision of becoming a leading digital hub.

Government Initiatives and Regulatory Support

The United Arab Emirates Telecom Market benefits significantly from proactive government initiatives and regulatory support aimed at fostering a competitive environment. The Telecommunications Regulatory Authority (TRA) has implemented various policies to encourage innovation and investment in the telecom sector. For instance, the TRA's recent initiatives to streamline licensing processes and promote fair competition among service providers have led to a more dynamic market landscape. Additionally, the government's commitment to enhancing digital infrastructure aligns with its broader vision of becoming a leading digital economy. As of October 2025, these efforts have resulted in increased foreign direct investment in the telecom sector, further stimulating growth and technological advancements. The supportive regulatory framework not only enhances service quality but also encourages the introduction of new services, thereby driving the overall development of the United Arab Emirates Telecom Market.

Adoption of Internet of Things (IoT) Solutions

The integration of Internet of Things (IoT) solutions is emerging as a pivotal driver within the United Arab Emirates Telecom Market. As businesses and consumers increasingly embrace smart technologies, the demand for IoT connectivity is on the rise. Reports indicate that the number of connected IoT devices in the UAE is projected to surpass 10 million by the end of 2025, reflecting a growing trend towards automation and smart living. Telecom operators are responding by developing tailored IoT solutions that cater to various sectors, including healthcare, transportation, and smart cities. This shift not only enhances operational efficiency but also opens new revenue streams for telecom providers. The increasing focus on IoT applications underscores the transformative potential of technology in the United Arab Emirates Telecom Market, positioning it as a key area for future growth and innovation.

Emergence of Artificial Intelligence in Telecom

The incorporation of Artificial Intelligence (AI) technologies is reshaping the landscape of the United Arab Emirates Telecom Market. Telecom operators are increasingly leveraging AI to enhance customer experience, optimize network management, and streamline operations. As of October 2025, AI-driven solutions are being utilized for predictive maintenance, customer service automation, and data analytics, enabling providers to respond more effectively to consumer needs. This technological evolution not only improves operational efficiency but also fosters innovation in service delivery. The growing emphasis on AI applications reflects a broader trend towards digital transformation within the telecom sector, as companies seek to differentiate themselves in a competitive market. The potential for AI to revolutionize service offerings and operational processes positions it as a critical driver of growth in the United Arab Emirates Telecom Market.