Shifts in Consumer Preferences

Consumer preferences are evolving within the United States Carpet Manufacturers Market, with a noticeable trend towards luxury and high-performance carpets. As disposable incomes rise, consumers are willing to invest in premium flooring options that offer durability and aesthetic appeal. This shift is prompting manufacturers to focus on producing carpets that not only meet functional needs but also enhance interior design. The demand for stylish and versatile carpets is likely to drive innovation in design and materials, as manufacturers strive to cater to the tastes of discerning consumers. This trend may also lead to increased competition among manufacturers to capture the attention of this lucrative market segment.

Increased Focus on Health and Wellness

The United States Carpet Manufacturers Market is witnessing an increased focus on health and wellness, influencing consumer choices in flooring materials. Carpets that promote better indoor air quality and are free from harmful chemicals are gaining traction among health-conscious consumers. This trend is supported by growing awareness of the impact of indoor environments on overall well-being. Manufacturers are responding by developing carpets that incorporate hypoallergenic and non-toxic materials, which could enhance their appeal in the market. As health and wellness continue to be prioritized, the demand for such carpets is expected to rise, potentially reshaping product offerings within the industry.

Rising Demand for Eco-Friendly Products

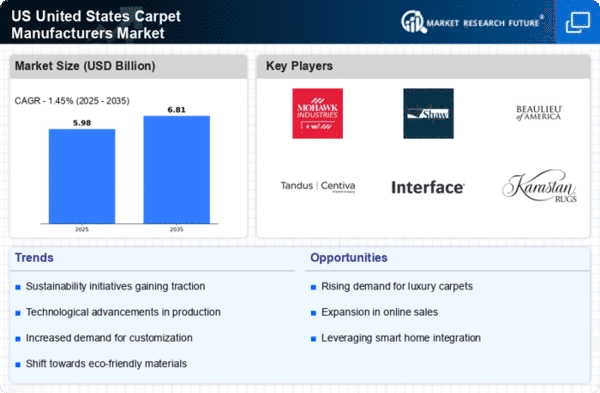

The United States Carpet Manufacturers Market is experiencing a notable shift towards eco-friendly products. Consumers are increasingly prioritizing sustainability, leading to a surge in demand for carpets made from recycled materials and natural fibers. This trend is reflected in the market, where eco-friendly carpets are projected to account for a significant portion of sales. Manufacturers are responding by innovating their product lines to include sustainable options, which not only appeal to environmentally conscious consumers but also align with regulatory pressures for greener production practices. As a result, the industry is likely to see a continued increase in the adoption of sustainable materials, which could reshape the competitive landscape.

Technological Advancements in Manufacturing

Technological advancements are playing a crucial role in the United States Carpet Manufacturers Market. Innovations such as automation, advanced weaving techniques, and digital printing are enhancing production efficiency and product quality. These technologies enable manufacturers to reduce waste and lower production costs, which is essential in a competitive market. Furthermore, the integration of smart technologies into carpet manufacturing processes allows for greater customization and personalization of products. As manufacturers adopt these technologies, they may gain a competitive edge, potentially leading to increased market share and profitability in the evolving landscape of carpet production.

Growth in Residential and Commercial Construction

The United States Carpet Manufacturers Market is closely tied to the construction sector, which is currently experiencing growth. As residential and commercial construction projects increase, so does the demand for flooring solutions, including carpets. According to recent data, the construction industry is projected to expand, driven by factors such as low interest rates and increased consumer confidence. This growth is likely to result in higher sales for carpet manufacturers, as new buildings require flooring installations. Additionally, renovations and remodeling projects in existing properties further contribute to the demand for carpets, indicating a robust market outlook for manufacturers.

Leave a Comment