Top Industry Leaders in the United Arab Emirates Telecom Market

United Arab Emirates Telecom Market: Dive into the Latest News and Updates

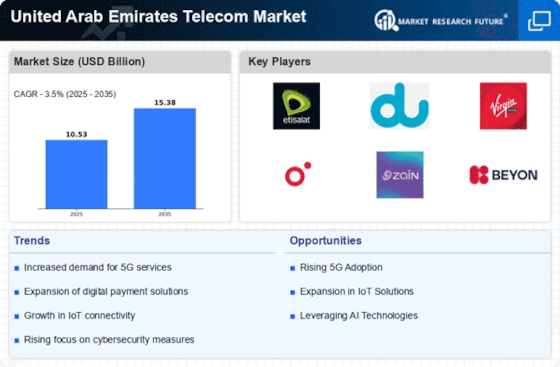

The United Arab Emirates (UAE) boasts a dynamic and rapidly evolving telecommunications market, fueled by a government commitment to digital transformation and a population with a high demand for advanced connectivity solutions. Understanding the key players, their strategies, and the factors influencing market share analysis is crucial for navigating this competitive landscape.

Some of United Arab Emirates Telecom Companies Listed Below:

- Etisalat Group

- Cisco Systems, Inc.

- Thuraya Telecommunications Company

- du (Emirates Integrated Telecommunications Company)

- Huawei Technologies Co., Ltd.

- Inmarsat plc

- Virgin Mobile United Arab Emirates

- Nokia Corporation

- Yahsat (Al Yah Satellite Communications Company)

- Ericsson

Strategies Driving Market Growth:

- Focus on 5G Network Deployment: Rapid rollout of 5G infrastructure across the UAE unlocks significant potential for high-speed data transfer, enabling applications like virtual reality, cloud gaming, and the Internet of Things (IoT) to flourish.

- Investment in Fiber Optic Infrastructure: Expanding fiber optic networks increases internet speeds and improves user experience, catering to the growing demand for bandwidth-intensive services.

- Data-Centric Service Offerings: Mobile operators are shifting focus towards data-centric plans and unlimited data packages, aligning with changing consumer behavior and mobile data usage patterns.

- Focus on Innovation and Value-Added Services: Telecom operators are introducing bundled packages with streaming services, cloud storage options, and other value-added services to attract and retain customers.

Factors Influencing Market Share Analysis:

- Network Coverage and Quality: Providing extensive network coverage and reliable connections across urban and rural areas is crucial for customer satisfaction and market leadership.

- Service Portfolio and Innovation: Offering a diverse range of competitive voice, data, and value-added services, along with consistent innovation, attracts different customer segments and fosters market share growth.

- Pricing Strategies and Affordability: Implementing competitive pricing models, catering to various budget segments, and offering flexible data plans are essential for attracting and retaining customers.

- Customer Service and User Experience: Providing excellent customer service, offering user-friendly interfaces, and implementing efficient billing systems enhance customer satisfaction and loyalty.

New and Emerging Companies:

- Focus on Niche Segments and Disruptive Pricing Models: Startups like Virgin Mobile and Friendi Mobile target specific customer segments like youth or budget-conscious users, offering disruptive pricing models and challenging established players.

- Focus on Emerging Technologies and IoT Solutions: Companies exploring areas like low-power wide-area networks (LPWAN) for IoT applications or offering specialized mobile virtual network operator (MVNO) services address specific market needs and promote innovation.

- Over-the-Top (OTT) Service Providers: The growing popularity of OTT services like Netflix and Amazon Prime Video creates opportunities for collaboration with telecom operators to develop bundled packages and leverage existing infrastructure.

Current Investment Trends:

- Government Investments in Infrastructure: The UAE government's continuous investment in building a robust and advanced telecom infrastructure, including submarine cables and data centers, facilitates market growth and attracts foreign investment.

- Strategic Partnerships and Acquisitions: Established operators are exploring partnerships or acquisitions with niche players or technology providers to expand their service offerings and address emerging market needs.

- Focus on Smart Cities and Connected Technologies: Investments in smart city initiatives and connected technologies like autonomous vehicles require robust telecom infrastructure, creating opportunities for telecom companies and technology providers.

Latest Company Updates:

- Mar 1, 2024: Dubai launches a new initiative to provide free Wi-Fi access in public transportation hubs, aiming to improve connectivity for residents and visitors.

- Feb 14, 2024: The UAE hosts the annual Gulf Communication and Information Technology Exhibition (GITEX), showcasing the latest advancements in telecom technologies and attracting international participation.