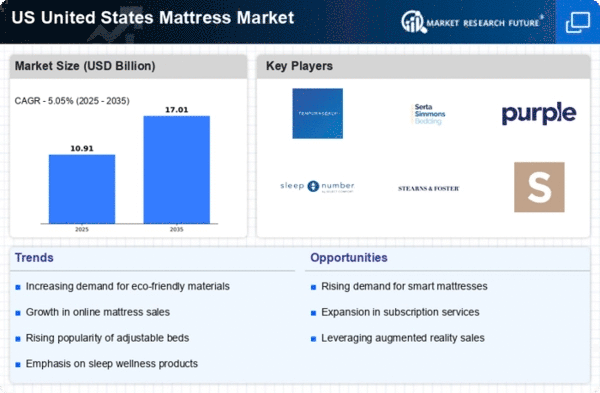

Rising Disposable Income

The upward trend in disposable income among American households is likely to have a substantial impact on the US Mattress Market. As financial stability improves, consumers are more inclined to invest in higher-quality sleep products. Data from the Bureau of Economic Analysis indicates that disposable personal income has steadily increased, suggesting that consumers are willing to spend more on premium mattresses. This shift towards quality over quantity may lead to a greater demand for luxury brands and innovative materials, such as organic and eco-friendly options. Furthermore, as consumers become more discerning, the market may witness a diversification of offerings, catering to various price points and preferences. This evolving landscape could foster a competitive environment, compelling manufacturers to enhance their product lines to meet the expectations of a more affluent consumer base.

Health and Wellness Trends

The increasing awareness of health and wellness among consumers appears to be a pivotal driver in the US Mattress Market. As individuals prioritize sleep quality, the demand for mattresses that promote better sleep hygiene is on the rise. Reports indicate that nearly 70 million Americans suffer from sleep disorders, which has led to a surge in interest for specialized mattresses, such as memory foam and hybrid options. These products are designed to alleviate pressure points and enhance spinal alignment, thereby improving overall sleep quality. Consequently, manufacturers are innovating to create mattresses that cater to these health-conscious consumers, potentially leading to a more competitive market landscape. The US Mattress Market is likely to see continued growth as consumers increasingly seek products that align with their health and wellness goals.

Urbanization and Lifestyle Changes

The ongoing trend of urbanization in the United States appears to be reshaping the US Mattress Market. As more individuals migrate to urban areas, the demand for space-efficient and multifunctional furniture, including mattresses, is likely to increase. Urban dwellers often face space constraints, leading to a preference for mattresses that can easily fit into smaller living environments. Additionally, lifestyle changes, such as the rise of remote work, may influence purchasing decisions, as consumers seek comfort and functionality in their sleep products. The market may see a growing interest in adjustable beds and compact mattress designs that cater to these evolving needs. This shift could drive innovation within the industry, prompting manufacturers to develop products that align with the preferences of urban consumers.

Sustainability and Eco-Friendly Products

The growing emphasis on sustainability is becoming a significant driver in the US Mattress Market. Consumers are increasingly seeking eco-friendly products that align with their values, leading to a rise in demand for mattresses made from organic materials and sustainable manufacturing processes. Reports suggest that approximately 30% of consumers are willing to pay a premium for environmentally friendly products, indicating a shift in purchasing behavior. This trend has prompted manufacturers to adopt sustainable practices, such as using recycled materials and reducing carbon footprints in production. As awareness of environmental issues continues to grow, the market is likely to see an influx of brands that prioritize sustainability, potentially reshaping consumer expectations and industry standards.

Technological Innovations in Sleep Products

Technological advancements are playing a crucial role in shaping the US Mattress Market. Innovations such as smart mattresses, which incorporate sleep tracking and temperature regulation features, are gaining traction among tech-savvy consumers. The integration of technology into sleep products appears to enhance the overall sleep experience, leading to increased consumer interest. Market data indicates that the smart mattress segment is projected to grow significantly, driven by the demand for personalized sleep solutions. As manufacturers continue to invest in research and development, the market may witness the introduction of new features that cater to the evolving needs of consumers. This technological evolution could potentially redefine the competitive landscape, as brands strive to differentiate themselves through innovative offerings.