Growing Awareness and Education

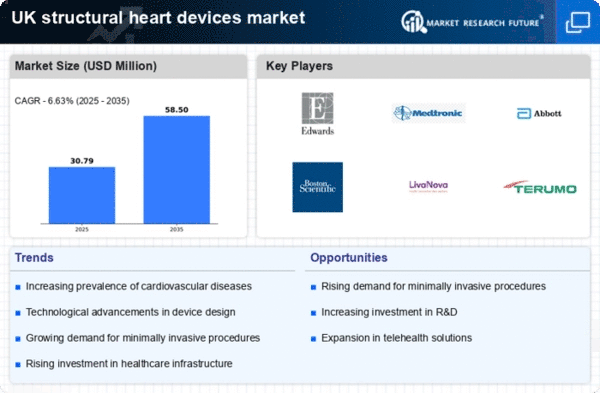

There is a notable increase in awareness and education regarding cardiovascular health among both healthcare professionals and the general public in the UK. Campaigns aimed at educating individuals about the risks associated with heart diseases and the benefits of early intervention are gaining traction. This heightened awareness is likely to drive demand for structural heart devices, as patients become more informed about their treatment options. Additionally, healthcare professionals are increasingly trained in the latest technologies and procedures related to structural heart devices, which may lead to more referrals and procedures being performed. As a result, the structural heart-devices market is poised for growth as both patients and providers recognize the importance of timely and effective treatment.

Increased Healthcare Expenditure

The structural heart-devices market is significantly influenced by the rising healthcare expenditure in the UK. Recent reports indicate that the UK government has committed to increasing the NHS budget, which is projected to reach £200 billion by 2024. This financial commitment allows for the adoption of advanced medical technologies, including structural heart devices, which are essential for treating complex cardiovascular conditions. As healthcare providers allocate more resources towards innovative treatments, the market for structural heart devices is expected to expand. Furthermore, increased funding for research and development in this sector may lead to the introduction of new and improved devices, thereby enhancing the overall quality of care for patients with structural heart issues.

Supportive Regulatory Environment

The regulatory environment in the UK is becoming increasingly supportive of innovations in the structural heart-devices market. Regulatory bodies, such as the Medicines and Healthcare products Regulatory Agency (MHRA), are streamlining the approval processes for new devices, which encourages manufacturers to invest in research and development. This supportive framework not only facilitates quicker access to market for new technologies but also enhances patient safety through rigorous evaluation standards. As a result, the structural heart-devices market is likely to benefit from a steady influx of innovative products, which can address the evolving needs of patients and healthcare providers alike. The combination of regulatory support and technological advancements may lead to a more dynamic and competitive market landscape.

Technological Innovations in Device Design

Technological innovations in the design and functionality of structural heart devices are transforming the market landscape in the UK. Advances in materials science and engineering have led to the development of devices that are not only more effective but also safer for patients. For instance, the introduction of bioresorbable materials and improved delivery systems has enhanced the performance of devices used in minimally invasive procedures. These innovations are likely to attract more healthcare providers to adopt structural heart devices, thereby expanding the market. Furthermore, ongoing research and development efforts are expected to yield even more sophisticated devices in the coming years, which could further stimulate growth in the structural heart-devices market.

Rising Prevalence of Cardiovascular Diseases

The increasing incidence of cardiovascular diseases in the UK is a primary driver for the structural heart-devices market. According to recent health statistics, cardiovascular diseases account for approximately 27% of all deaths in the UK, highlighting a critical need for effective treatment options. This growing health concern is prompting healthcare providers to seek advanced solutions, including structural heart devices, to manage conditions such as heart valve disorders and congenital heart defects. The demand for innovative devices is expected to rise as the population ages and the prevalence of risk factors, such as obesity and diabetes, increases. Consequently, The structural heart-devices market is likely to experience substantial growth. This growth will occur as healthcare systems adapt to these challenges and invest in new technologies to improve patient outcomes.