Growing Awareness and Education

There is a notable increase in awareness and education regarding cardiovascular health in Japan, which serves as a catalyst for the structural heart-devices market. Public health campaigns and initiatives by healthcare organizations are effectively informing the population about the risks associated with heart diseases and the available treatment options. This heightened awareness is leading to earlier diagnosis and treatment, thereby increasing the demand for structural heart devices. Furthermore, healthcare professionals are receiving enhanced training on the latest technologies and procedures, which is likely to improve patient outcomes. As more individuals seek medical intervention for heart-related issues, the structural heart-devices market is expected to expand, driven by informed patients and skilled practitioners.

Increased Healthcare Expenditure

Japan's healthcare expenditure has been on the rise, which is a significant driver for the structural heart-devices market. The government has been investing heavily in healthcare infrastructure and technology to improve patient care and outcomes. In 2025, healthcare spending is expected to reach approximately ¥42 trillion, reflecting a commitment to enhancing medical services. This increase in funding allows for the procurement of advanced medical devices, including those used in structural heart interventions. As hospitals and clinics upgrade their facilities and equipment, the demand for innovative structural heart devices is likely to grow. This trend indicates a robust market environment, where healthcare providers are better equipped to address the needs of patients with cardiovascular diseases.

Rising Prevalence of Cardiovascular Diseases

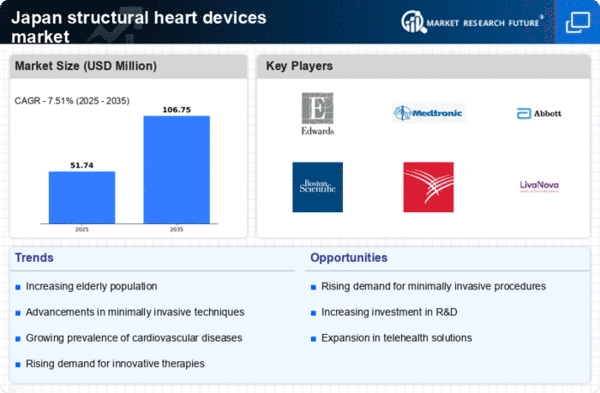

The increasing incidence of cardiovascular diseases in Japan is a primary driver for the structural heart-devices market. According to recent health statistics, cardiovascular diseases account for approximately 30% of all deaths in the country. This alarming trend necessitates advanced medical interventions, including structural heart devices, to manage and treat these conditions effectively. The demand for innovative solutions is further fueled by the aging population, which is more susceptible to heart-related ailments. As healthcare providers seek to improve patient outcomes, investments in structural heart devices are likely to rise, thereby expanding the market. The structural heart-devices market is expected to witness substantial growth as hospitals and clinics adopt these technologies to address the growing burden of cardiovascular diseases.

Advancements in Minimally Invasive Procedures

Minimally invasive procedures are transforming the landscape of cardiac interventions in Japan, significantly impacting the structural heart-devices market. These techniques offer numerous advantages, including reduced recovery times, lower risk of complications, and shorter hospital stays. As a result, there is a growing preference among both patients and healthcare providers for these innovative approaches. The introduction of advanced structural heart devices, such as transcatheter aortic valve replacements (TAVR) and left atrial appendage closure devices, aligns with this trend. Market data indicates that the adoption of minimally invasive techniques is projected to increase by 20% over the next five years, further driving the demand for structural heart devices. This shift not only enhances patient care but also encourages the development of new technologies within the market.

Technological Integration in Healthcare Systems

Advanced technologies are significantly influencing the structural heart-devices market in Japan. The adoption of electronic health records (EHRs), telemedicine, and artificial intelligence (AI) is streamlining patient management and enhancing the efficiency of cardiac care. These technologies facilitate better data collection and analysis, allowing for more personalized treatment plans. As healthcare providers increasingly rely on these innovations, the demand for compatible structural heart devices is likely to rise. Market projections suggest that the incorporation of technology in healthcare will grow by 15% annually, further propelling the structural heart-devices market. This trend underscores the importance of technological advancements in improving patient care and outcomes in the realm of cardiovascular health.