Supportive Reimbursement Policies

Supportive reimbursement policies in the US are playing a pivotal role in the growth of the structural heart-devices market. Insurance providers are increasingly recognizing the value of advanced structural heart devices and are offering favorable reimbursement rates for these procedures. This trend is encouraging healthcare providers to adopt innovative technologies, as the financial burden on patients is reduced. Additionally, government programs and initiatives aimed at improving access to cardiac care are further bolstering the market. As reimbursement policies evolve to support the use of advanced devices, the structural heart-devices market is expected to expand, providing patients with greater access to life-saving treatments and improving overall health outcomes.

Technological Innovations in Device Design

Technological innovations in the design and functionality of structural heart devices are transforming the market landscape. Advances in materials science, imaging technologies, and minimally invasive techniques are enabling the development of more effective and safer devices. For instance, the introduction of bioresorbable stents and transcatheter heart valves has revolutionized treatment options for patients with structural heart conditions. These innovations not only enhance patient outcomes but also reduce recovery times and hospital stays, making them attractive options for both patients and healthcare providers. As manufacturers continue to invest in research and development, the structural heart-devices market is likely to witness a surge in new product launches and improved device performance, further driving market growth.

Rising Prevalence of Cardiovascular Diseases

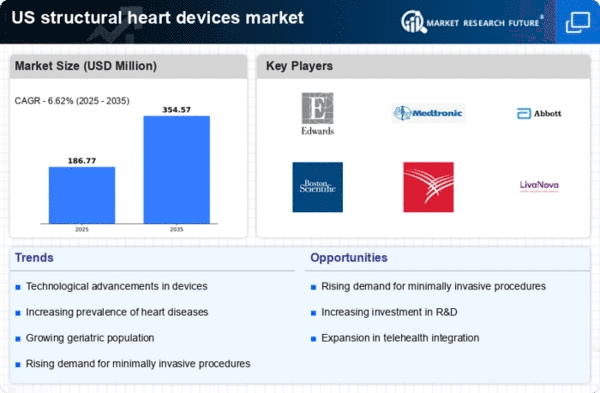

The increasing incidence of cardiovascular diseases in the US is a primary driver for the structural heart-devices market. According to the American Heart Association, cardiovascular diseases account for approximately 1 in every 4 deaths in the US. This alarming statistic highlights the urgent need for effective treatment options, including structural heart devices. As the population ages and lifestyle-related health issues become more prevalent, the demand for innovative solutions to manage these conditions is expected to rise. The structural heart-devices market is likely to benefit from this trend, as healthcare providers seek advanced technologies to improve patient outcomes and reduce healthcare costs. Furthermore, The market is projected to grow at a CAGR of around 8% from 2025 to 2035.

Growing Awareness and Education on Heart Health

The rising awareness and education regarding heart health among the US population is a crucial driver for the structural heart-devices market. Public health campaigns and initiatives aimed at educating individuals about cardiovascular diseases and their risk factors have led to increased screening and early diagnosis. As more people become aware of their heart health, there is a greater likelihood of seeking medical intervention, which includes the use of structural heart devices. This heightened awareness is expected to contribute to the growth of the market, as patients are more inclined to explore treatment options. Furthermore, healthcare providers are increasingly emphasizing the importance of preventive care, which may lead to earlier interventions and a higher demand for innovative devices in the structural heart-devices market.

Increased Investment in Healthcare Infrastructure

Investment in healthcare infrastructure in the US is significantly impacting the structural heart-devices market. With the ongoing expansion of hospitals and specialized cardiac care centers, there is a growing demand for advanced medical technologies. The US government and private sector are allocating substantial funds to enhance healthcare facilities, which includes the procurement of state-of-the-art structural heart devices. This trend is expected to create a favorable environment for manufacturers and suppliers in the structural heart-devices market. As healthcare facilities upgrade their equipment and technology, the adoption of innovative devices is likely to increase, thereby driving market growth. Additionally, the focus on improving patient care and outcomes is pushing healthcare providers to invest in advanced solutions, further propelling the demand for structural heart devices.