Focus on Patient-Centric Care

The Transcatheter Embolization and Occlusion Devices Market is increasingly aligning with the focus on patient-centric care, which emphasizes personalized treatment approaches. Healthcare providers are recognizing the importance of tailoring interventions to meet individual patient needs, particularly in the context of embolization procedures. This shift is driven by the growing body of evidence supporting the efficacy of personalized medicine, which has been shown to improve patient outcomes. As a result, manufacturers are developing devices that can be customized for specific clinical scenarios, thereby enhancing their appeal in the market. The trend towards patient-centric care is expected to drive a 10% increase in the adoption of transcatheter devices, as healthcare systems prioritize interventions that align with patient preferences and clinical requirements.

Rising Healthcare Expenditure

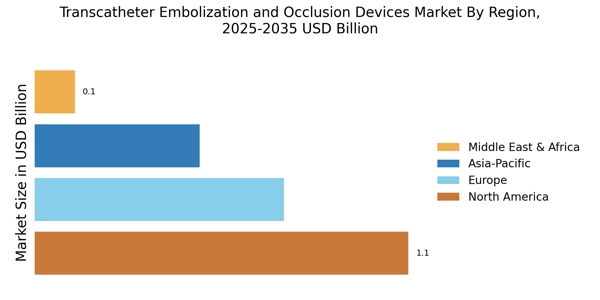

The increasing healthcare expenditure across various regions is a pivotal factor influencing the Transcatheter Embolization and Occlusion Devices Market. As governments and private sectors allocate more resources to healthcare, there is a corresponding rise in the availability and accessibility of advanced medical technologies. This trend is particularly evident in emerging markets, where investments in healthcare infrastructure are expanding rapidly. Reports indicate that healthcare spending is projected to grow by 5% annually, facilitating the adoption of innovative embolization devices. Consequently, healthcare providers are more likely to invest in transcatheter technologies, which are essential for addressing complex medical conditions. This influx of funding is expected to bolster market growth and enhance patient care.

Increasing Incidence of Vascular Diseases

The rising prevalence of vascular diseases, including aneurysms and arteriovenous malformations, is a significant driver for the Transcatheter Embolization and Occlusion Devices Market. As populations age and lifestyle-related health issues become more common, the demand for effective treatment options is escalating. Reports indicate that the incidence of vascular diseases is expected to rise by 20% in the next decade, necessitating the use of embolization devices for effective management. This trend is further supported by the growing awareness of the benefits of transcatheter procedures, which are less invasive compared to traditional surgical methods. Consequently, healthcare systems are increasingly investing in advanced embolization technologies to address this growing health concern, thereby propelling market growth.

Technological Innovations in Device Design

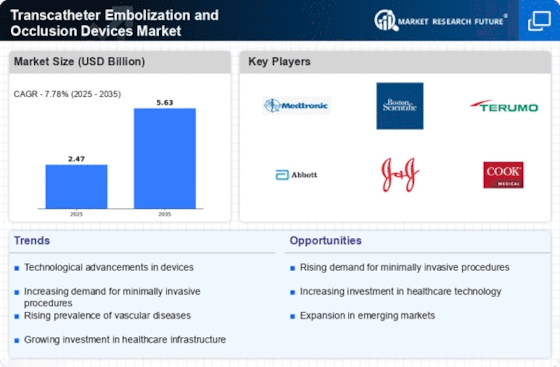

The Transcatheter Embolization and Occlusion Devices Market is experiencing a surge in technological innovations that enhance device efficacy and safety. Recent advancements in materials science have led to the development of biocompatible and bioresorbable materials, which are crucial for reducing complications associated with traditional embolization devices. Furthermore, the integration of imaging technologies, such as fluoroscopy and ultrasound, into device design allows for real-time monitoring during procedures, thereby improving patient outcomes. According to industry reports, the market is projected to grow at a compound annual growth rate of approximately 7.5% over the next five years, driven by these technological advancements. As a result, healthcare providers are increasingly adopting these innovative devices, which are likely to reshape treatment protocols in interventional radiology.

Shift Towards Minimally Invasive Procedures

The Transcatheter Embolization and Occlusion Devices Market is witnessing a notable shift towards minimally invasive procedures, which are preferred by both patients and healthcare providers. These procedures typically result in shorter recovery times, reduced hospital stays, and lower overall healthcare costs. As a result, there is a growing inclination among clinicians to adopt transcatheter techniques for various therapeutic applications, including tumor embolization and uterine artery embolization. Market analysis suggests that the demand for minimally invasive solutions is likely to increase by 15% annually, as patients increasingly seek alternatives to traditional surgical interventions. This trend is further supported by advancements in device technology, which enhance the safety and effectiveness of these procedures, thereby driving market expansion.