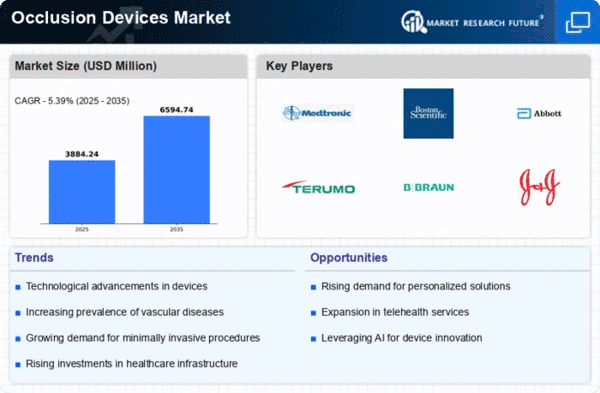

Market Growth Projections

The Global Occlusion Devices Market Industry is projected to experience substantial growth over the coming years. With an estimated market value of 2.18 USD Billion in 2024, the industry is on track to reach 3.14 USD Billion by 2035. This growth trajectory indicates a compound annual growth rate (CAGR) of 3.37% from 2025 to 2035. Such projections reflect the increasing demand for occlusion devices driven by advancements in technology, rising healthcare expenditures, and a growing emphasis on minimally invasive procedures. The market's expansion is likely to create opportunities for innovation and improved patient outcomes.

Regulatory Support and Approvals

Regulatory support and streamlined approval processes for medical devices are crucial factors influencing the Global Occlusion Devices Market Industry. Regulatory bodies are increasingly recognizing the need for efficient pathways to bring innovative occlusion devices to market. This support fosters an environment conducive to research and development, encouraging manufacturers to invest in new technologies. As a result, the market is expected to experience robust growth, with an emphasis on compliance and safety standards. The proactive stance of regulatory agencies may enhance the overall landscape for occlusion devices, facilitating their integration into clinical practice.

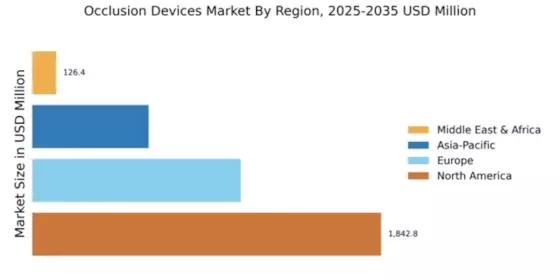

Increasing Healthcare Expenditure

Rising healthcare expenditure across various regions is a pivotal driver for the Global Occlusion Devices Market Industry. Governments and private sectors are investing more in healthcare infrastructure, which includes the procurement of advanced medical devices. This trend is particularly evident in emerging economies, where healthcare budgets are expanding to accommodate new technologies. As a result, the market is anticipated to grow, reaching 3.14 USD Billion by 2035. This increase in funding is likely to facilitate the adoption of occlusion devices, thereby enhancing treatment options for patients.

Rising Prevalence of Cardiovascular Diseases

The increasing incidence of cardiovascular diseases globally drives the demand for occlusion devices. As per recent statistics, cardiovascular diseases remain a leading cause of mortality, prompting healthcare systems to seek effective solutions. The Global Occlusion Devices Market Industry is expected to benefit from this trend, as occlusion devices play a crucial role in managing conditions such as atrial fibrillation and coronary artery disease. With the market projected to reach 2.18 USD Billion in 2024, the focus on innovative occlusion technologies is likely to intensify, addressing the urgent need for improved patient outcomes.

Technological Advancements in Occlusion Devices

Technological innovations are significantly influencing the Global Occlusion Devices Market Industry. The development of advanced materials and minimally invasive techniques enhances the efficacy and safety of occlusion devices. For instance, the introduction of bioresorbable occlusion devices offers promising alternatives to traditional options, potentially reducing complications. As the market evolves, these advancements are expected to contribute to a projected growth rate of 3.37% CAGR from 2025 to 2035. This growth reflects the industry's commitment to improving patient care through cutting-edge technology.

Growing Awareness of Minimally Invasive Procedures

The growing awareness and preference for minimally invasive procedures among patients and healthcare providers significantly impact the Global Occlusion Devices Market Industry. Patients increasingly seek treatments that offer reduced recovery times and lower risks of complications. Consequently, occlusion devices, which are often associated with minimally invasive techniques, are gaining traction. This shift in patient preference is likely to drive market growth, as healthcare providers adapt to meet these demands. The anticipated market expansion underscores the importance of aligning product offerings with evolving patient expectations.