Supportive Regulatory Environment

A supportive regulatory environment plays a vital role in the growth of the Transcatheter Aortic Valve Replacement Market Industry. Regulatory bodies are increasingly recognizing the importance of innovative medical devices and are streamlining the approval processes for new technologies. This trend facilitates quicker access to advanced transcatheter aortic valve replacement solutions for patients in need. The establishment of clear guidelines and frameworks for clinical trials also encourages manufacturers to invest in research and development. As a result, the market is likely to witness an influx of new products and technologies, enhancing competition and driving growth within the Transcatheter Aortic Valve Replacement Market Industry.

Expanding Healthcare Infrastructure

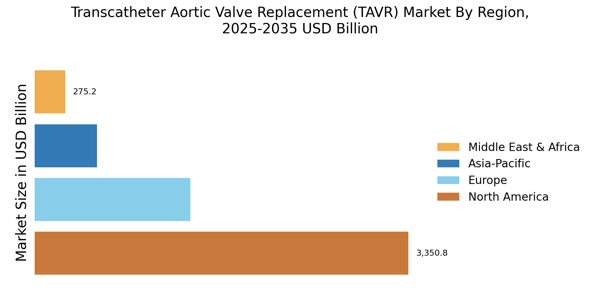

The expansion of healthcare infrastructure, particularly in emerging markets, is a significant driver of the Transcatheter Aortic Valve Replacement Market Industry. As healthcare systems evolve and improve, access to advanced medical technologies becomes more widespread. Investments in hospitals and specialized cardiac centers are increasing, enabling more facilities to offer transcatheter aortic valve replacement procedures. This trend is particularly evident in regions where healthcare access has historically been limited. As more healthcare providers adopt these technologies, the overall market is expected to grow, reflecting the increasing demand for effective treatment options in the Transcatheter Aortic Valve Replacement Market Industry.

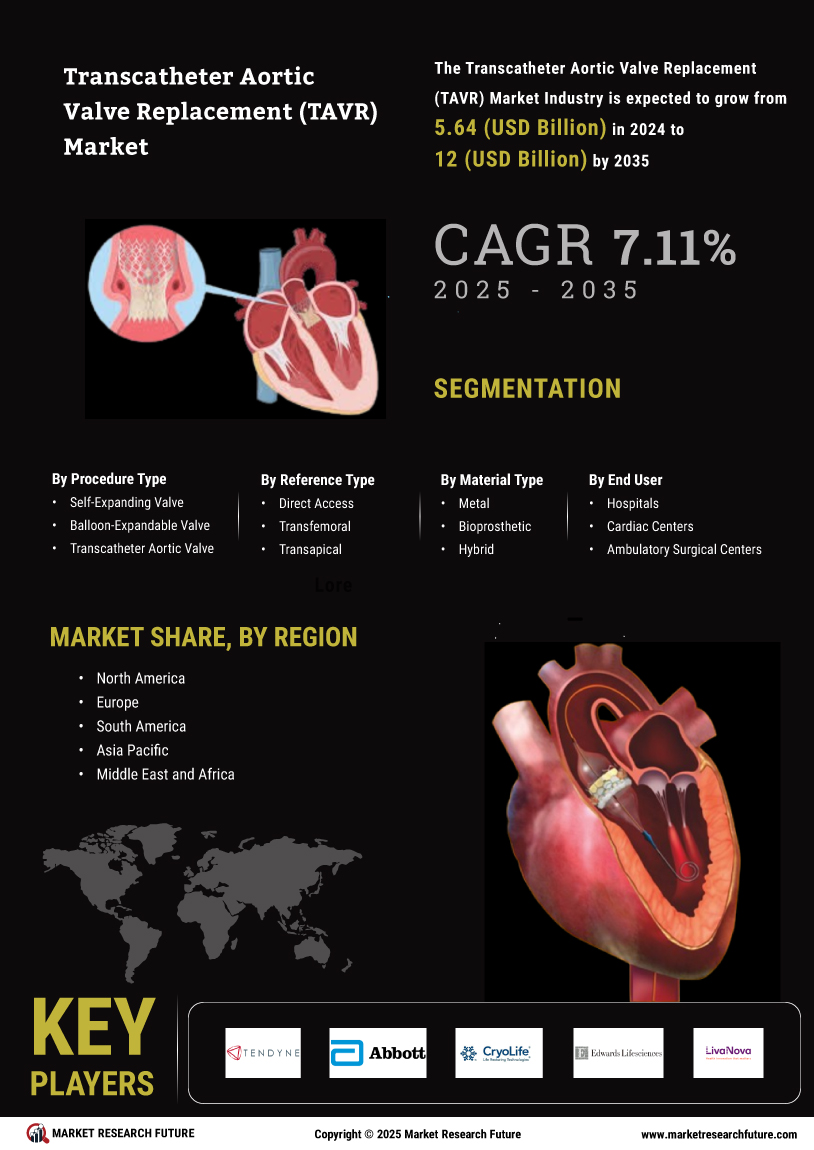

Increasing Prevalence of Aortic Stenosis

The rising incidence of aortic stenosis, particularly among the aging population, is a primary driver of the Transcatheter Aortic Valve Replacement Market Industry. As individuals age, the risk of developing heart valve diseases escalates, leading to a greater demand for effective treatment options. According to recent estimates, aortic stenosis affects approximately 2-7% of individuals over the age of 65. This demographic shift is likely to propel the market forward, as more patients seek minimally invasive procedures like transcatheter aortic valve replacement. The increasing prevalence of comorbidities, such as hypertension and diabetes, further exacerbates the situation, necessitating innovative solutions in the Transcatheter Aortic Valve Replacement Market Industry.

Technological Innovations in Valve Design

Technological advancements in valve design and delivery systems are significantly influencing the Transcatheter Aortic Valve Replacement Market Industry. Innovations such as the development of self-expanding valves and improved delivery catheters enhance procedural success rates and patient outcomes. These advancements not only reduce the risk of complications but also expand the eligibility criteria for patients who may benefit from the procedure. The introduction of next-generation valves, which offer better hemodynamic performance and durability, is expected to drive market growth. As these technologies continue to evolve, they may lead to increased adoption rates among healthcare providers, thereby positively impacting the Transcatheter Aortic Valve Replacement Market Industry.

Rising Awareness and Acceptance of Minimally Invasive Procedures

There is a growing awareness and acceptance of minimally invasive procedures among both patients and healthcare professionals, which is a crucial driver for the Transcatheter Aortic Valve Replacement Market Industry. Patients are increasingly seeking alternatives to traditional surgical approaches due to the associated benefits, such as shorter recovery times and reduced hospital stays. Educational initiatives and outreach programs by healthcare organizations have contributed to this trend, highlighting the advantages of transcatheter aortic valve replacement. As more patients become informed about their treatment options, the demand for these procedures is likely to rise, further propelling the Transcatheter Aortic Valve Replacement Market Industry.