Advancements in Imaging Technologies

The evolution of imaging technologies, such as MRI, CT scans, and fluoroscopy, plays a crucial role in enhancing the efficacy of transcatheter embolization procedures. These advancements allow for improved visualization of vascular structures, enabling more precise targeting during embolization. As a result, the transcatheter embolization-and-occlusion-devices market is likely to benefit from the integration of these technologies, which can lead to better patient outcomes and reduced procedural complications. The market for imaging technologies is projected to grow significantly, with estimates suggesting a CAGR of around 6% over the next few years. This synergy between imaging and embolization techniques may drive healthcare providers to adopt these devices more widely, thereby fostering market expansion.

Increasing Prevalence of Chronic Diseases

The rising incidence of chronic diseases such as cancer, cardiovascular disorders, and liver diseases is a primary driver for the transcatheter embolization-and-occlusion-devices market. As these conditions often require interventional procedures, the demand for effective embolization techniques is likely to increase. According to recent data, chronic diseases account for approximately 70% of all deaths in the US, highlighting the urgent need for innovative treatment options. This trend suggests that healthcare providers are increasingly adopting transcatheter embolization techniques to manage these conditions, thereby propelling market growth. Furthermore, the aging population, which is more susceptible to chronic ailments, is expected to further amplify the demand for these devices, indicating a robust market trajectory in the coming years.

Expansion of Product Offerings by Key Players

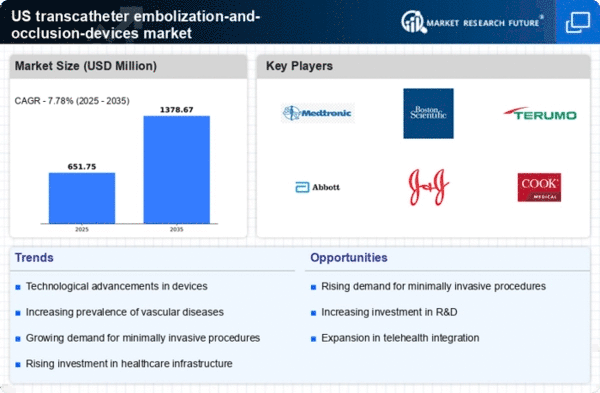

The transcatheter embolization-and-occlusion-devices market is witnessing an expansion of product offerings by key players, which is likely to enhance competition and drive innovation. Major manufacturers are investing in research and development to introduce advanced embolization devices that cater to a wider range of clinical applications. This includes the development of new materials, designs, and delivery systems that improve the efficacy and safety of embolization procedures. As companies strive to differentiate their products, the market is expected to see a surge in innovative solutions that meet the evolving needs of healthcare providers. This competitive landscape may lead to increased adoption of transcatheter embolization devices, further propelling market growth.

Growing Investment in Healthcare Infrastructure

Increased investment in healthcare infrastructure, particularly in interventional radiology departments, is a significant driver for the transcatheter embolization-and-occlusion-devices market. Hospitals and clinics are allocating more resources to upgrade their facilities and acquire advanced medical equipment, including embolization devices. This trend is supported by government initiatives aimed at improving healthcare access and quality. For instance, the US government has committed substantial funding to enhance healthcare services, which is likely to facilitate the adoption of innovative treatment modalities. As healthcare facilities become better equipped, the demand for transcatheter embolization devices is expected to rise, indicating a positive outlook for the market.

Rising Awareness and Education Among Healthcare Professionals

The increasing awareness and education regarding the benefits of transcatheter embolization techniques among healthcare professionals is driving the market forward. As more practitioners become knowledgeable about the advantages of these minimally invasive procedures, the adoption rate is likely to increase. Educational programs, workshops, and conferences focused on interventional radiology are becoming more prevalent, contributing to a better understanding of the applications and effectiveness of embolization devices. This heightened awareness may lead to a greater willingness among healthcare providers to recommend and utilize transcatheter embolization techniques, thereby positively impacting the market. The trend suggests a growing recognition of the importance of these devices in modern medical practice.