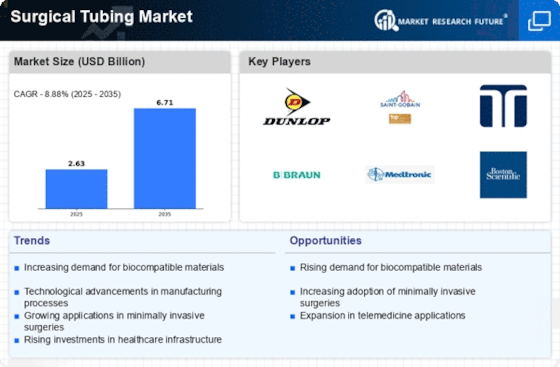

Growth of the Healthcare Sector

The Surgical Tubing Market is significantly influenced by the overall growth of the healthcare sector. As healthcare expenditures rise, there is an increased investment in surgical facilities and technologies. This growth is reflected in the expansion of hospitals and surgical centers, which require a steady supply of surgical tubing for various procedures. Market data indicates that healthcare spending is expected to grow at a rate of 6% annually, which will likely lead to an increased demand for surgical tubing. This trend underscores the interdependence between healthcare infrastructure development and the surgical tubing market, suggesting a positive outlook for future growth.

Regulatory Support and Standards

The Surgical Tubing Market benefits from a robust regulatory framework that ensures the safety and efficacy of medical devices. Regulatory bodies have established stringent standards for surgical tubing, which fosters consumer confidence and encourages manufacturers to innovate. Compliance with these regulations often leads to improved product quality and performance, which is crucial in a field where patient safety is paramount. As manufacturers strive to meet these standards, the market is likely to see an influx of high-quality surgical tubing products. This regulatory support not only enhances market credibility but also stimulates competition among manufacturers, further driving market growth.

Rising Awareness of Patient Safety

The Surgical Tubing Market is increasingly shaped by the growing awareness of patient safety and quality of care. Healthcare providers are placing greater emphasis on using high-quality, reliable surgical products to minimize risks during procedures. This heightened focus on patient safety drives demand for surgical tubing that meets stringent quality standards. As hospitals and surgical centers adopt best practices to enhance patient outcomes, the preference for superior surgical tubing options is likely to increase. This trend not only reflects a shift in healthcare priorities but also indicates a potential for market expansion as manufacturers respond to the demand for safer surgical solutions.

Increasing Demand for Surgical Procedures

The Surgical Tubing Market experiences a notable surge in demand due to the rising number of surgical procedures performed annually. Factors such as an aging population and the prevalence of chronic diseases contribute to this trend. According to recent data, the number of surgical procedures is projected to increase by approximately 5% annually, leading to a corresponding rise in the need for surgical tubing. This increase is particularly evident in areas such as cardiovascular and orthopedic surgeries, where specialized tubing is essential for effective procedures. As healthcare providers seek to enhance patient outcomes, the demand for high-quality surgical tubing continues to grow, thereby driving the market forward.

Technological Innovations in Surgical Tubing

Technological advancements play a pivotal role in shaping the Surgical Tubing Market. Innovations in materials and manufacturing processes have led to the development of more durable and flexible surgical tubing options. For instance, the introduction of biocompatible materials has enhanced the safety and efficacy of surgical procedures. Furthermore, the market has witnessed the emergence of advanced manufacturing techniques, such as 3D printing, which allows for customized surgical tubing solutions tailored to specific surgical needs. These innovations not only improve the performance of surgical tubing but also expand its applications across various medical fields, thereby propelling market growth.