Regulatory Compliance

Regulatory compliance is a significant driver in the Fluoropolymer Tubing Market, as various sectors face stringent regulations regarding material safety and environmental impact. Industries such as pharmaceuticals and food processing are particularly affected, as they must adhere to rigorous standards to ensure product safety and quality. Fluoropolymer tubing, known for its non-reactive nature and ability to withstand extreme conditions, is often favored for applications requiring compliance with these regulations. The increasing focus on safety and environmental sustainability is likely to propel the demand for fluoropolymer tubing, as companies seek materials that meet or exceed regulatory requirements. This trend indicates a robust growth trajectory for the Fluoropolymer Tubing Market, as compliance becomes a critical factor in material selection.

Focus on Sustainability

The Fluoropolymer Tubing Market is increasingly aligning with sustainability initiatives as companies seek to reduce their environmental footprint. The production of fluoropolymer tubing often involves processes that minimize waste and energy consumption, appealing to environmentally conscious consumers and businesses. Furthermore, the durability and longevity of fluoropolymer materials contribute to reduced waste over time, as they require less frequent replacement compared to traditional materials. As sustainability becomes a core value for many organizations, the demand for eco-friendly materials is likely to rise. This shift suggests that the Fluoropolymer Tubing Market may experience growth as manufacturers adapt to meet the evolving expectations of their customers, thereby enhancing their market position.

Technological Advancements

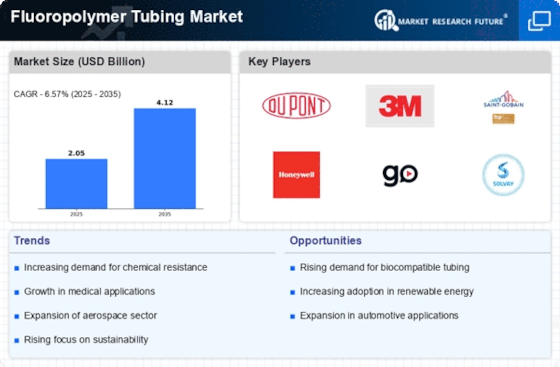

The Fluoropolymer Tubing Market is experiencing a surge in technological advancements that enhance the performance and application range of fluoropolymer tubing. Innovations in manufacturing processes, such as improved extrusion techniques and enhanced polymer formulations, are leading to products with superior chemical resistance and thermal stability. These advancements are particularly relevant in industries such as pharmaceuticals and food processing, where stringent regulations necessitate high-quality materials. The market is projected to grow at a compound annual growth rate (CAGR) of approximately 6% over the next five years, driven by these technological improvements. As manufacturers continue to invest in research and development, the potential for new applications in various sectors appears promising, thereby expanding the overall market landscape.

Rising Demand in Electronics

The Fluoropolymer Tubing Market is experiencing rising demand in the electronics sector, driven by the need for high-performance materials in various applications. Fluoropolymer tubing is utilized in wire insulation, cable jacketing, and other electronic components due to its excellent dielectric properties and resistance to heat and chemicals. As the electronics industry continues to evolve, with trends such as miniaturization and increased functionality, the demand for reliable and durable materials is expected to grow. Recent market analyses suggest that the electronics segment could account for over 25% of the overall market by 2026, highlighting the importance of fluoropolymer tubing in this rapidly advancing field. This trend underscores the potential for continued expansion within the Fluoropolymer Tubing Market.

Increasing Industrial Applications

The Fluoropolymer Tubing Market is witnessing a notable increase in industrial applications, particularly in sectors such as chemical processing, oil and gas, and aerospace. The unique properties of fluoropolymer tubing, including excellent chemical resistance and low friction, make it an ideal choice for transporting aggressive fluids and gases. According to recent estimates, the industrial segment accounts for nearly 40% of the total market share, reflecting a growing reliance on these materials for critical applications. As industries continue to prioritize efficiency and safety, the demand for high-performance tubing solutions is likely to rise. This trend suggests that the Fluoropolymer Tubing Market will continue to expand, driven by the need for reliable and durable materials in challenging environments.