Surgical Tubing Size

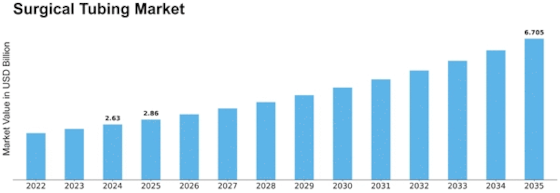

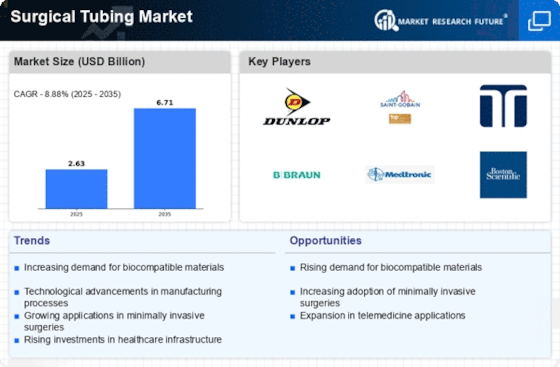

Surgical Tubing Market Growth Projections and Opportunities

The Surgical Tubing Market is heavily influenced by advancements in medical technology. Innovations in materials, design, and manufacturing processes contribute to the development of surgical tubing with improved flexibility, durability, and biocompatibility, thus impacting market growth. The increasing surgical procedures worldwide directly fuels the demand for medical tubing. However, as more surgical interventions go into practice the demand for high quality tubing goes through extensive growth in application like catheters drainage systems and fluid management system. There is one essential point that needs to be brought out and it has something to do with the choice of materials for surgical tubing. Current research and development is aimed at manufacturing tubing from sophisticated materials that possess better characteristics like chemical resistance, biocompatibility etc… The legal strictness high standards are essential in the surgical tubing market. Compliance with quality and safety guidelines ensures that medical devices utilizing tubing inherently conform to the requirements provided, driving market competition. Since chronic diseases demand long-term medical intervention, the incidence of such health issues determines a substantial requirement for surgical tubing. Diabetes, cardiovascular diseases as well ast cancer require the use of tubing in different medical devices for treatment and control. The emerging demographic trend towards an aging population is amongst the major market drivers. Patients above sixty need medical intervention employing surgical tubes, including materials in the catheter and involved lines expanding the market. The technology embodied in the surgical tubing market and robotics, smart medical devices etc. drives adoption of these products among health care workers both for patient- maintenance as well as operation. The need to consider the compatibility of tubing with advanced technological medical equipment also becomes prominent for manufacturer hence laser surface treatment seems suitable.

The ability of manufacturers to offer customized solutions and differentiate their products influences market dynamics. Customized tubing solutions that meet specific medical requirements or offer unique features gain a competitive edge in the market.

Leave a Comment