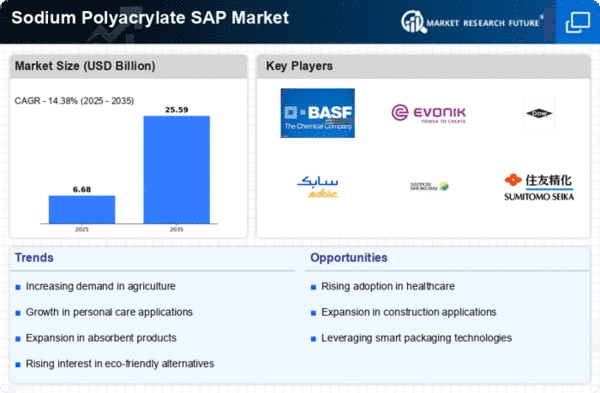

The Sodium Polyacrylate SAP Market is characterized by a dynamic competitive landscape, driven by increasing demand across various applications, including personal care, agriculture, and medical sectors. Key players such as BASF SE (Germany), Evonik Industries AG (Germany), and The Dow Chemical Company (US) are strategically positioned to leverage innovation and sustainability initiatives. These companies are focusing on enhancing their product portfolios through research and development, while also exploring mergers and acquisitions to strengthen their market presence. The collective strategies of these firms contribute to a competitive environment that is increasingly focused on technological advancements and sustainable practices.In terms of business tactics, companies are localizing manufacturing to reduce lead times and optimize supply chains, which is particularly crucial in a market that is moderately fragmented. This approach not only enhances operational efficiency but also allows for better responsiveness to regional market demands. The competitive structure is shaped by the presence of both large multinational corporations and smaller regional players, creating a diverse landscape where collaboration and competition coexist.

In November BASF SE (Germany) announced the launch of a new line of biodegradable sodium polyacrylate products aimed at the agricultural sector. This strategic move is significant as it aligns with the growing trend towards sustainability, catering to environmentally conscious consumers and regulatory demands. By introducing biodegradable options, BASF SE positions itself as a leader in sustainable solutions, potentially capturing a larger market share in the eco-friendly segment.

In October Evonik Industries AG (Germany) expanded its production capacity for sodium polyacrylate at its facility in Germany. This expansion is indicative of Evonik's commitment to meeting the rising global demand for superabsorbent polymers, particularly in the hygiene and agricultural markets. By increasing production capabilities, Evonik not only enhances its competitive edge but also ensures a reliable supply chain, which is crucial in maintaining customer satisfaction and loyalty.

In September The Dow Chemical Company (US) entered into a strategic partnership with a leading agricultural technology firm to develop innovative applications for sodium polyacrylate in soil moisture retention. This collaboration is noteworthy as it combines Dow's chemical expertise with cutting-edge agricultural technology, potentially leading to groundbreaking solutions that address water scarcity issues. Such partnerships are becoming increasingly vital in the current market, as they foster innovation and enhance product offerings.

As of December the Sodium Polyacrylate SAP Market is witnessing trends that emphasize digitalization, sustainability, and the integration of artificial intelligence in production processes. Strategic alliances are playing a crucial role in shaping the competitive landscape, enabling companies to pool resources and expertise. Looking ahead, the focus is likely to shift from price-based competition to differentiation through innovation, technology, and supply chain reliability. This evolution suggests that companies that prioritize sustainable practices and technological advancements will be better positioned to thrive in an increasingly competitive market.