Market Analysis

In-depth Analysis of Sodium Polyacrylate SAP Market Industry Landscape

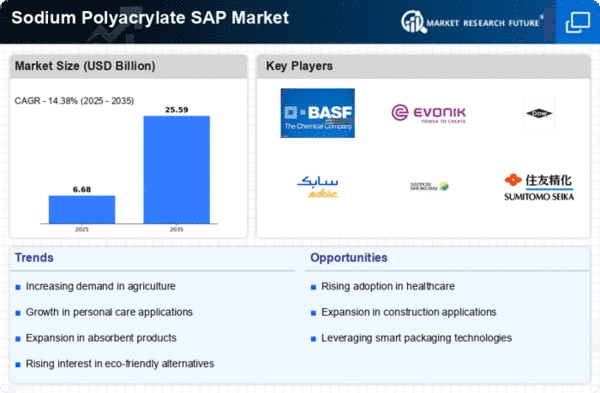

The market dynamics of sodium polyacrylate (SAP) are driven by a variety of factors that influence its supply, demand, and pricing. Sodium polyacrylate, a superabsorbent polymer, finds widespread use in various industries, including hygiene products, agriculture, healthcare, and construction. One of the primary drivers shaping the market dynamics is the increasing demand for SAP in the hygiene products sector. SAP is a key component in the manufacturing of disposable diapers, adult incontinence products, and feminine hygiene products due to its exceptional absorbent properties. As the global population grows, especially in emerging economies, and standards of living improve, the demand for hygiene products containing SAP continues to rise, driving market growth.

Supply-side factors play a crucial role in the market dynamics of sodium polyacrylate. The production of SAP involves polymerization processes using acrylic acid or acrylamide monomers, which are derived from petrochemical sources. Therefore, the availability and cost of raw materials, as well as advancements in polymerization technologies, significantly impact production capacity and supply levels. Additionally, the presence of key manufacturers and their production capabilities influence market dynamics, with expansions or disruptions affecting supply volumes and pricing.

Global trade patterns and regulatory frameworks contribute to the complexity of SAP market dynamics. Many countries rely on imports to meet their demand for SAP, leading to fluctuations in prices and supply chains. Trade policies, tariffs, and regulations related to the import and export of chemicals influence market dynamics by affecting supply levels and pricing structures. Moreover, regulatory measures regarding product quality, safety standards, and environmental regulations impact the production, distribution, and usage of SAP, influencing market dynamics and pricing strategies.

The pricing dynamics of SAP are influenced by various factors, including raw material costs, production costs, and market competition. Fluctuations in the prices of acrylic acid or acrylamide monomers, which are the primary raw materials for SAP production, directly impact production costs, thereby influencing pricing dynamics. Energy prices and transportation costs also contribute to production expenses, affecting pricing strategies adopted by manufacturers. Market competition among suppliers and manufacturers further influences pricing dynamics, with companies adjusting their pricing strategies to gain market share or maintain profitability in a competitive landscape.

Demand-side factors, such as evolving consumer preferences and trends in end-user industries, shape the market dynamics of SAP. In the hygiene products sector, the demand for disposable diapers, adult incontinence products, and feminine hygiene products is influenced by factors such as population demographics, urbanization trends, and consumer awareness about hygiene and sanitation. Moreover, technological advancements in SAP formulations, such as improved absorbency and biodegradability, drive demand for next-generation products, impacting market dynamics and pricing strategies.

Market dynamics in the SAP sector are also influenced by cyclical trends and seasonal variations. Certain industries, such as agriculture, experience higher demand for SAP during specific times of the year, such as planting seasons, when water retention and soil conditioning properties are crucial for crop growth. Moreover, economic factors, global crises, and shifts in consumer behavior can disrupt supply chains, affect consumer spending, and impact the overall demand for SAP, leading to fluctuations in market dynamics and pricing structures.

Leave a Comment