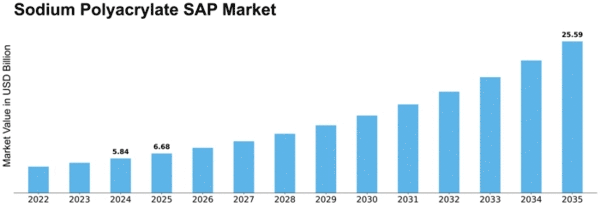

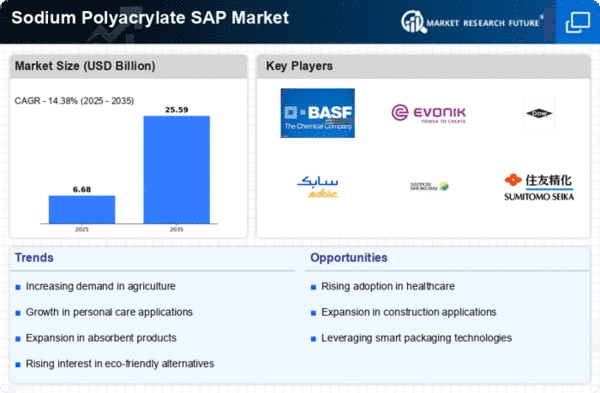

Sodium Polyacrylate Sap Size

Sodium Polyacrylate SAP Market Growth Projections and Opportunities

The sodium polyacrylate (SAP) market is influenced by several key factors that shape its production, demand, and pricing dynamics. One of the primary drivers of this market is the widespread application of sodium polyacrylate in various industries, particularly in the personal care, agriculture, and packaging sectors. In personal care products, sodium polyacrylate is commonly used as a superabsorbent polymer in diapers, feminine hygiene products, and adult incontinence pads due to its exceptional liquid absorption properties. The increasing demand for disposable hygiene products, driven by factors such as rising birth rates, aging populations, and changing consumer lifestyles, fuels the growth of the SAP market.

Another significant factor influencing the sodium polyacrylate market is its use in agriculture as a soil conditioner and water retention agent. Sodium polyacrylate can improve soil structure, enhance water retention capacity, and reduce irrigation frequency, thereby promoting plant growth and increasing crop yields. With the growing global population and expanding agricultural activities, there is a rising demand for technologies and products that improve agricultural productivity and sustainability, driving the adoption of sodium polyacrylate in the agricultural sector.

Furthermore, the availability and cost of raw materials play a crucial role in shaping the sodium polyacrylate market. Polyacrylic acid, the precursor to sodium polyacrylate, is typically derived from acrylic acid, which is produced through the oxidation of propylene or ethylene. Fluctuations in the prices of propylene, ethylene, and other raw materials used in acrylic acid production can impact the production costs of sodium polyacrylate. Additionally, factors such as feedstock availability, supply chain disruptions, and geopolitical tensions can influence the availability and pricing of raw materials, thereby affecting market dynamics.

Moreover, technological advancements in SAP production processes contribute to the growth and evolution of the sodium polyacrylate market. Manufacturers are continually innovating to improve production efficiency, reduce energy consumption, and enhance product performance. For instance, advancements in polymerization techniques and reactor design have led to the development of high-performance sodium polyacrylate polymers with tailored properties suited for specific applications. These technological innovations not only drive down production costs but also enable the development of new and improved SAP-based products.

Additionally, regulatory policies and standards governing the use of sodium polyacrylate in various applications influence market dynamics. Regulatory requirements related to product safety, environmental impact, and quality standards drive compliance measures for manufacturers and end-users. Compliance with regulations ensures market acceptance and fosters consumer trust in the efficacy and safety of sodium polyacrylate products. Moreover, regulatory changes and updates can create opportunities or challenges for market players, depending on their ability to adapt and innovate.

Market competition is another significant factor shaping the sodium polyacrylate market landscape. The presence of multiple manufacturers and suppliers competing for market share can lead to price competition and product differentiation strategies. Factors such as product quality, reliability, technical support, and distribution networks play crucial roles in gaining a competitive edge within the market. Strategic alliances, partnerships, and mergers & acquisitions are common strategies adopted by market players to strengthen their market position and expand their customer base.

Furthermore, global economic conditions and trade policies impact the sodium polyacrylate market on a broader scale. Economic growth or recession in key regions can influence consumer spending patterns and overall demand for sodium polyacrylate products. Trade policies, tariffs, and geopolitical tensions can also affect supply chains and trade flows, thereby impacting market dynamics and prices.

Leave a Comment