Market Trends

Key Emerging Trends in the Sodium Polyacrylate SAP Market

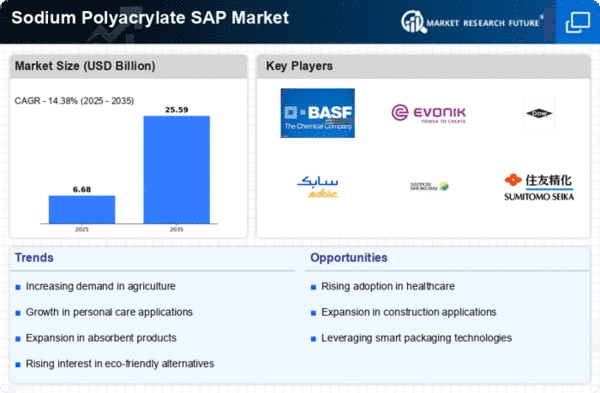

The sodium polyacrylate (SAP) market is witnessing significant trends that are reshaping its dynamics and driving growth across various industries. One notable trend is the increasing demand for SAP in the personal care and hygiene sector. SAP is widely used in the manufacturing of diapers, feminine hygiene products, and adult incontinence pads due to its exceptional absorbent properties. With the growing population, rising awareness about hygiene, and increasing disposable incomes, the demand for SAP-based products is on the rise globally. Moreover, advancements in SAP technology have led to the development of thinner and more efficient absorbent cores in hygiene products, enhancing user comfort and performance.

Furthermore, there is a growing trend towards the use of SAP in agriculture as a water-absorbent polymer for soil conditioning and water retention. SAP helps improve soil structure, enhance water retention capacity, and reduce irrigation frequency, thereby increasing crop yield and improving agricultural productivity. With the growing need to optimize water usage in agriculture, particularly in regions facing water scarcity and drought conditions, the demand for SAP as a soil amendment is increasing. Moreover, SAP-based soil conditioners offer environmental benefits by reducing water runoff and soil erosion, further driving their adoption in sustainable agriculture practices.

Additionally, the SAP market is experiencing significant growth in the construction and packaging sectors. SAP is utilized as a superabsorbent material in construction applications such as concrete additives, mortar, and grouts to enhance workability, reduce shrinkage, and improve durability. Moreover, SAP-based materials are used in packaging applications to absorb and retain moisture, ensuring the freshness and shelf life of perishable goods during storage and transportation. With increasing construction activities and the growing demand for innovative packaging solutions, the demand for SAP in these sectors is expected to continue to rise.

Moreover, there is a growing trend towards the development of biodegradable and environmentally friendly SAP products. Traditional SAPs are derived from petroleum-based sources and are non-biodegradable, raising concerns about their long-term environmental impact. In response, manufacturers are investing in research and development to develop bio-based SAPs derived from renewable sources such as plant starches and cellulose. These bio-based SAPs offer similar performance characteristics to conventional SAPs while providing environmental benefits such as biodegradability and reduced carbon footprint, driving their adoption in various applications.

Furthermore, technological advancements and innovation are driving the growth of the SAP market. Manufacturers are investing in R&D to develop advanced SAP formulations with improved performance, such as enhanced absorbency, retention capacity, and gel strength. Moreover, advancements in production technologies are enabling the cost-effective manufacturing of SAPs on a large scale, making them more accessible to a wide range of industries. Additionally, innovations in SAP processing and application methods are expanding the scope of SAP usage in new and emerging applications, further driving market growth.

Additionally, regulatory developments and sustainability initiatives are shaping the SAP market landscape. Regulatory agencies are imposing stricter regulations on the use of chemicals in consumer products, necessitating compliance with safety and environmental standards for SAP-based products. Moreover, increasing consumer awareness about sustainability and environmental conservation is driving companies to adopt eco-friendly manufacturing practices and develop sustainable product alternatives. As a result, companies in the SAP market are focusing on sustainability initiatives, such as reducing energy consumption, optimizing resource usage, and minimizing waste generation, to meet regulatory requirements and consumer expectations.

Leave a Comment