Market Growth Projections

The Global Smart TV Market Industry is poised for remarkable growth, with projections indicating a market size of 245.2 USD Billion in 2024 and an astonishing 1061.4 USD Billion by 2035. This trajectory suggests a robust compound annual growth rate (CAGR) of 14.25% from 2025 to 2035. The anticipated growth is driven by various factors, including technological advancements, increasing consumer demand for interactive content, and the integration of smart home technologies. As the market evolves, it is likely to witness innovations that further enhance user experiences and expand the functionalities of Smart TVs, solidifying their position in the entertainment landscape.

Rising Demand for Streaming Services

The Global Smart TV Market Industry is experiencing a surge in demand for streaming services, driven by the increasing popularity of platforms such as Netflix, Hulu, and Amazon Prime Video. As consumers seek high-quality content and convenience, Smart TVs equipped with advanced streaming capabilities are becoming essential. In 2024, the market is projected to reach 245.2 USD Billion, reflecting a shift in viewing habits. This trend indicates that consumers prefer on-demand content over traditional cable subscriptions, leading to a significant increase in Smart TV Market sales. The integration of user-friendly interfaces and smart features further enhances the appeal of these devices.

Integration of Smart Home Technologies

The integration of Smart home technologies is significantly influencing the Global Smart TV Market Industry. As households increasingly adopt smart devices, Smart TVs serve as central hubs for controlling various home automation systems. This interconnectedness enhances user convenience and promotes the adoption of Smart TVs. The growing trend of voice-activated assistants and IoT connectivity further solidifies the role of Smart TVs in modern homes. With the market projected to grow at a CAGR of 14.25% from 2025 to 2035, the synergy between Smart TVs and other smart devices is likely to drive substantial growth, as consumers seek seamless integration and enhanced functionalities.

Expansion of Global Internet Connectivity

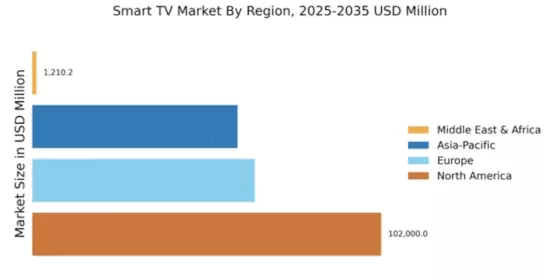

The expansion of global internet connectivity is a crucial driver of the Global Smart TV Market Industry. As internet access becomes more widespread, particularly in developing regions, the potential customer base for Smart TVs is expanding. Improved broadband infrastructure and the proliferation of affordable internet services are enabling more households to access streaming content and online services. This trend is likely to contribute to the overall growth of the Smart TV Market, as consumers in these regions increasingly adopt Smart TVs to take advantage of available online content. The combination of enhanced connectivity and growing consumer awareness is expected to propel market growth.

Technological Advancements in Display Quality

Technological advancements in display quality are a pivotal driver of the Global Smart TV Market Industry. Innovations such as 4K and 8K resolution, OLED, and QLED technologies are enhancing the viewing experience, making Smart TVs more appealing to consumers. As these technologies become more affordable, a broader audience is likely to adopt Smart TVs. The market's growth trajectory suggests that by 2035, it could reach 1061.4 USD Billion, indicating a robust demand for high-definition viewing experiences. Enhanced picture quality not only attracts consumers but also encourages content providers to produce more high-resolution content, creating a positive feedback loop.

Increasing Consumer Preference for Interactive Content

Increasing consumer preference for interactive content is reshaping the Global Smart TV Market Industry. Viewers are gravitating towards content that allows for engagement, such as gaming, live streaming, and interactive applications. This shift is prompting manufacturers to enhance Smart TV Market features, including gaming capabilities and interactive interfaces. As a result, Smart TVs are becoming more than just passive viewing devices; they are evolving into platforms for immersive experiences. The anticipated growth in the market underscores the importance of catering to this demand, as consumers seek devices that offer diverse entertainment options and interactive functionalities.