Technological Advancements in IoT

The integration of Internet of Things (IoT) technology into lighting systems is a pivotal driver for the Global Smart Lighting Market Industry. IoT-enabled smart lighting allows for remote control, automation, and data collection, enhancing user experience and operational efficiency. With advancements in wireless communication technologies, such as Zigbee and Wi-Fi, smart lighting systems can be seamlessly integrated into smart homes and cities. This technological evolution is likely to propel the market forward, with projections indicating a compound annual growth rate (CAGR) of 16.66% from 2025 to 2035, as more consumers adopt these innovative solutions.

Growing Demand for Energy Efficiency

The Global Smart Lighting Market Industry is experiencing a surge in demand for energy-efficient solutions as consumers and businesses seek to reduce energy consumption and costs. Smart lighting systems, which utilize LED technology and intelligent controls, can lead to significant energy savings. For instance, it is estimated that smart lighting can reduce energy usage by up to 70% compared to traditional lighting. This trend is expected to drive the market's growth, with the market projected to reach 16.7 USD Billion in 2024, reflecting a growing awareness of sustainability and energy conservation.

Government Initiatives and Regulations

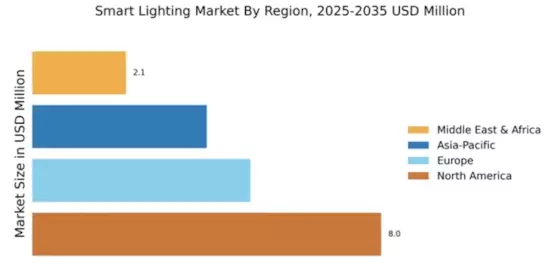

Government initiatives aimed at promoting energy efficiency and sustainability are significantly influencing the Global Smart Lighting Market Industry. Various countries are implementing regulations that encourage the adoption of smart lighting technologies, often providing incentives for businesses and homeowners. For example, energy efficiency programs in Europe and North America are designed to facilitate the transition to smart lighting solutions. These initiatives not only aim to reduce carbon footprints but also enhance public safety and urban aesthetics. As a result, the market is expected to expand, with a projected value of 90.9 USD Billion by 2035, driven by supportive policies and funding.

Increased Focus on Public Safety and Security

Public safety and security concerns are increasingly influencing the Global Smart Lighting Market Industry. Smart lighting systems equipped with sensors and cameras can enhance surveillance and deter criminal activities in public spaces. Cities are adopting smart lighting solutions to improve visibility and safety in high-crime areas, thereby fostering a sense of security among residents. This trend is particularly evident in urban areas where crime rates are a concern. The implementation of smart lighting for public safety is expected to drive market growth, as municipalities recognize the benefits of investing in advanced lighting technologies.

Rising Urbanization and Smart City Development

The rapid pace of urbanization and the development of smart cities are key factors driving the Global Smart Lighting Market Industry. As urban populations grow, the demand for efficient and sustainable lighting solutions becomes increasingly critical. Smart lighting plays a vital role in smart city initiatives, providing enhanced safety, improved energy management, and better public services. Cities worldwide are investing in smart lighting infrastructure to address these challenges, leading to a projected market growth. The integration of smart lighting in urban planning is likely to contribute to the overall market expansion, aligning with global trends toward sustainable urban development.