Expansion of Content Availability

The Smart TV market in France is significantly influenced by the expansion of content availability across various streaming platforms. With the proliferation of services such as Netflix, Amazon Prime Video, and local providers, consumers are presented with a diverse array of viewing options. Recent statistics indicate that over 70% of French households subscribe to at least one streaming service, which in turn drives the demand for smart TVs that can seamlessly access these platforms. This trend suggests that the smart tv market is likely to continue growing as consumers seek devices that enhance their viewing experiences through easy access to a wide range of content.

Rising Consumer Interest in Smart Features

The Smart TV market in France experiences a notable surge in consumer interest towards advanced features such as voice control, artificial intelligence, and personalized content recommendations. This trend appears to be driven by a growing desire for enhanced user experiences and convenience. According to recent data, approximately 65% of French consumers express a preference for smart TVs equipped with these functionalities. As a result, manufacturers are increasingly focusing on integrating innovative technologies into their products, thereby expanding the smart tv market. This shift not only caters to consumer preferences but also positions brands competitively in a rapidly evolving landscape.

Increased Adoption of Smart Home Ecosystems

The Smart TV market in France is witnessing a rise in the adoption of smart home ecosystems, where smart TVs serve as central hubs for controlling various connected devices. This integration appears to be appealing to tech-savvy consumers who seek convenience and interoperability among their devices. Recent surveys indicate that around 40% of French consumers own multiple smart home devices, and many express a preference for TVs that can easily connect and interact with these devices. This trend suggests that the smart tv market may continue to expand as manufacturers focus on creating products that enhance the smart home experience.

Technological Advancements in Display Quality

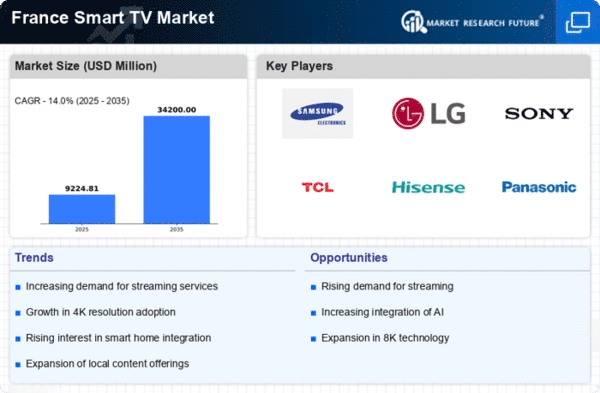

Technological advancements in display quality are playing a crucial role in shaping the smart tv market in France. Innovations such as 4K and 8K resolution, OLED, and QLED technologies are becoming increasingly prevalent, appealing to consumers who prioritize superior visual experiences. Data indicates that the sales of 4K smart TVs have surged, accounting for approximately 55% of total smart TV sales in the country. This trend suggests that as display technologies continue to evolve, they will likely drive further growth in the smart tv market, as consumers are drawn to the enhanced clarity and color accuracy offered by these advanced displays.

Growing Awareness of Health and Wellness Features

The Smart TV market in France is increasingly influenced by a growing awareness of health and wellness features integrated into smart TVs. Consumers are becoming more conscious of their viewing habits and the impact of screen time on health. As a result, manufacturers are introducing features that promote healthier viewing experiences, such as blue light reduction and screen time management tools. Recent data suggests that approximately 30% of French consumers consider health-related features when purchasing a smart TV. This trend indicates that the smart tv market may evolve to prioritize health-conscious innovations, appealing to a demographic that values well-being alongside entertainment.