Rising Demand for Smart Features

The increasing consumer preference for smart features in televisions is a notable driver in the smart tv market. In Germany, households are progressively seeking televisions that offer integrated applications, voice control, and connectivity with other smart devices. This trend is reflected in the market data, which indicates that approximately 65% of consumers prioritize smart functionalities when purchasing a new television. As a result, manufacturers are compelled to innovate and enhance their offerings to meet these expectations. The smart tv market is thus experiencing a shift towards more advanced models that cater to tech-savvy consumers, driving sales and market growth.

Growth of Online Content Consumption

The surge in online content consumption is significantly influencing the smart tv market. In Germany, the number of streaming subscriptions has reached over 30 million, indicating a robust demand for smart televisions that can seamlessly access various platforms. This trend suggests that consumers are increasingly favoring smart tvs that provide easy access to popular streaming services. Consequently, the smart tv market is adapting by incorporating features that enhance streaming capabilities, such as improved internet connectivity and user-friendly interfaces. This shift not only boosts sales but also encourages competition among manufacturers to deliver superior products.

Increased Focus on Home Entertainment

The growing emphasis on home entertainment is a critical driver for the smart tv market. In Germany, consumers are investing more in home entertainment systems, with smart televisions being a central component. This trend is evidenced by a reported increase in sales of smart tvs by approximately 20% over the past year. The smart tv market is responding by offering models that integrate advanced audio-visual technologies and compatibility with home theater systems. As consumers seek to replicate cinema-like experiences at home, the demand for high-quality smart tvs continues to rise, further stimulating market growth.

Technological Advancements in Display Quality

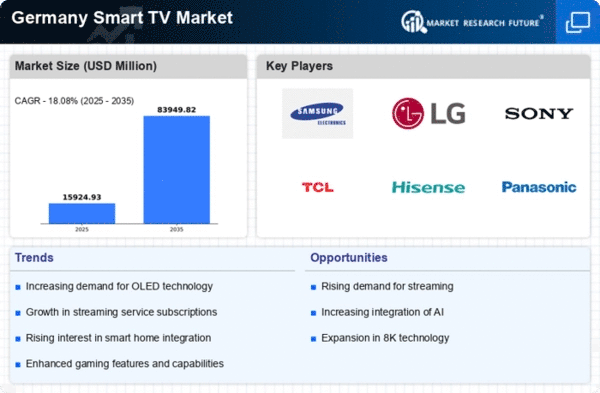

Technological advancements in display quality are propelling the smart tv market forward. Innovations such as 4K and 8K resolution, OLED, and QLED technologies are becoming more prevalent in the German market. As consumers become more discerning about picture quality, the demand for high-definition displays is on the rise. Market data suggests that around 40% of new television purchases in Germany are for models featuring 4K resolution or higher. This trend indicates that the smart tv market must continuously evolve to incorporate cutting-edge display technologies, thereby enhancing the viewing experience and attracting more customers.

Rising Consumer Awareness of Smart Home Integration

The rising consumer awareness of smart home integration is shaping the smart tv market landscape. In Germany, an increasing number of households are adopting smart home devices, leading to a demand for televisions that can seamlessly integrate with these systems. Market Research Future indicates that nearly 50% of consumers express interest in smart tvs that can control other smart devices, such as lighting and security systems. This trend suggests that the smart tv market must focus on developing products that enhance interoperability with various smart home technologies, thereby appealing to a broader audience and driving sales.